[ad_1]

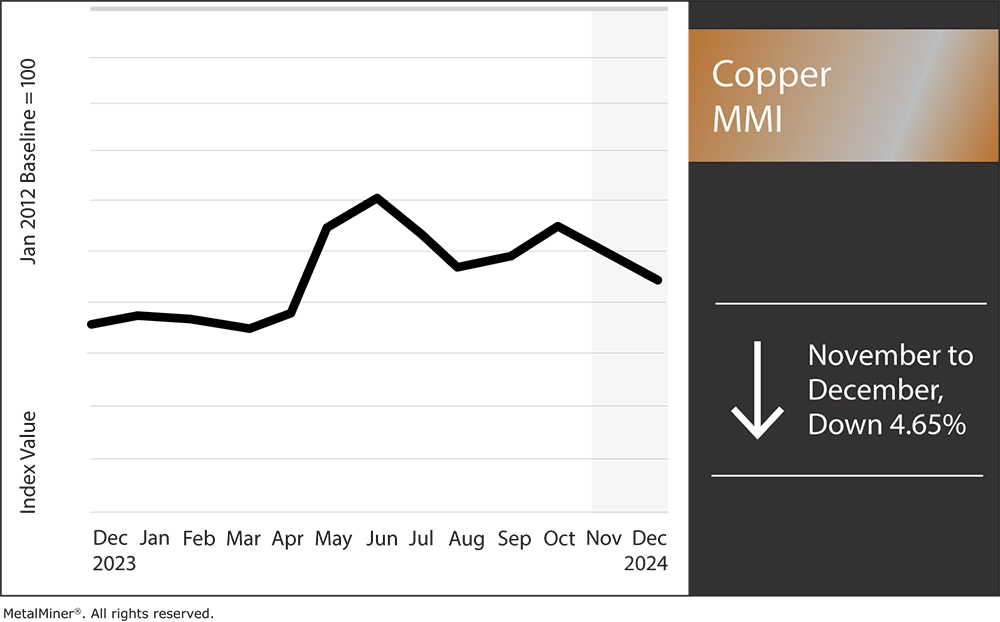

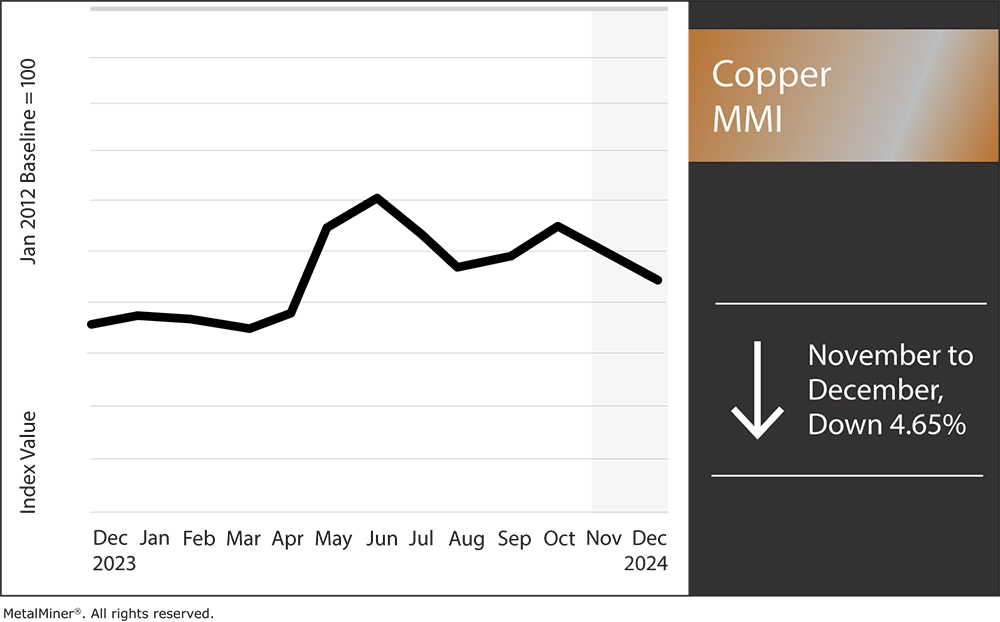

Overall, the Copper Monthly Metals Index (MMI) remained bearish, with a 4.65% decline from November to December.

Copper Prices to Close 2024 Up, But the Outlook is Down

Often a bellwether for the global economy, the price of copper became a bellwether for market emotionality throughout 2024. Despite lackluster demand conditions, copper prices embarked on a volatile year, which had knock-on effects for the entire base metal category.

Copper and other commodity markets are constantly shifting. Get all of the latest updates with MetalMiner’s weekly newsletter.

Q1

2024 saw a rather auspicious start. Many believed markets were on the heels of the Federal Reserve’s first rate cut since March 2020. Markets also expected U.S. infrastructure and renewable efforts to gain momentum during the year, which would offer support to copper prices amid supply deficit concerns. However, sticky inflation and strong economic numbers got in the way of those hopes, while global demand conditions remained constrained.

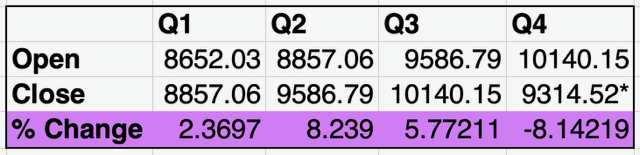

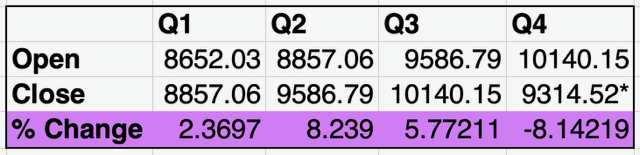

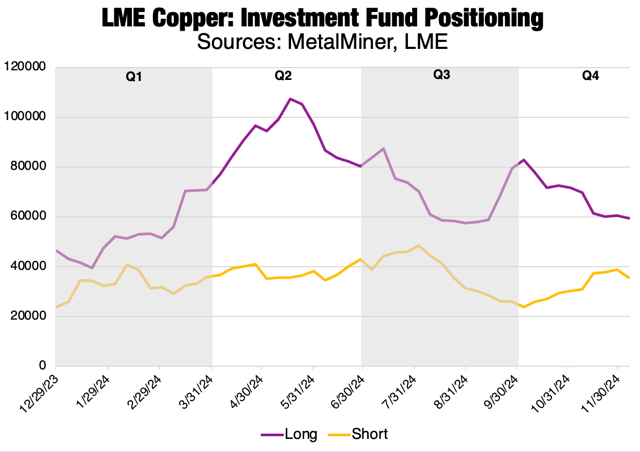

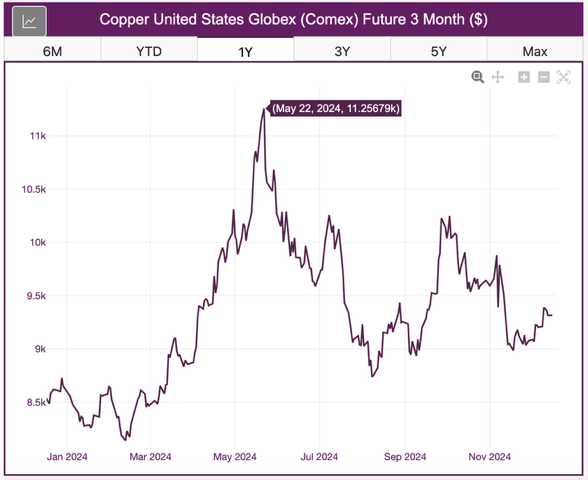

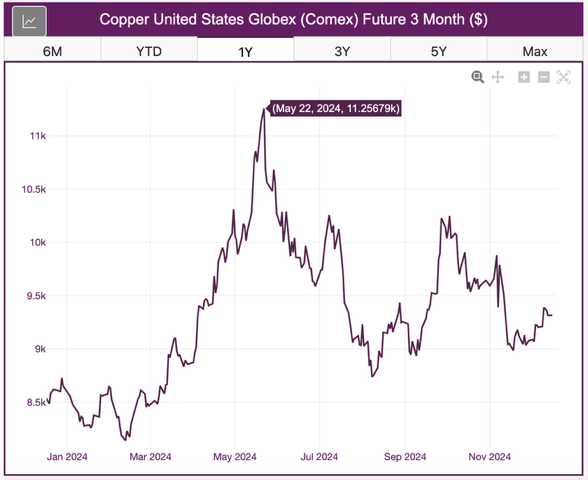

As a result, Comex copper prices trended sideways through much of the first quarter. However, reports of plunging treatment and refining charges appeared to spook markets enough to see prices spike out of range by late March. Meanwhile, investment funds helped trigger the rise as they started to pile on long bets, offering momentum to the copper price trend. Overall, this translated to a modest 2.37% increase from the close of 2023 to the end of Q1.

Q2

The momentum continued throughout Q2, with liquidity increasing across the entire base metal category. Even nickel, which had been plagued by a trading exodus since the March 2022 nickel squeeze, witnessed a notable increase in long bets. Many investors believed markets were on the verge of a supercycle. This was particularly true of copper, which investors saw as driven by rising electrification demand and constrained mine supply.

Despite rising prices, metal markets appeared mostly well-stocked. Three month futures prices showed a rising premium over their primary cash counterparts for several metals, indicating spot demand was simply not keeping up with future expectations. Beyond that, rate cuts from the Fed had yet to arrive.

By late May, low Comex copper stocks triggered a short squeeze on short bet investors. This forced them to buy material to close out those bets, which led to a drop in Comex stocks and a sharp rise in copper prices. On May 22, Comex copper price hit a new all-time high at $11,257/mt, overtaking its previous all-time high of $10,885/mt in March 2022.

The peak concluded the speculative uptrend, resulting in an equally sharp downside retracement in the following months. While the peak represented more than a 30% jump from the start of the year, copper prices witnessed only an 8.24% overall rise during Q2. It was still the best-performing quarter of 2024 for copper prices.

Subscribe to MetalMiner’s free Monthly Metals Index report and leverage it as a valuable resource for tracking and predicting copper price trends.

Q3

Aside from a short-lived jump at the start of the quarter, Q3 opened with copper prices still in retracement from the Q2 uptrend. Prices finally found a bottom by early August, not far from where they closed Q1. However, the following months proved especially volatile as prices began to rally once again ahead of the Fed’s first rate cut of 2024.

China announced new stimulus measures, offering additional support to prices. Combined with news of the impending October port strike, prices rallied to their highest level since early July. Prices went on to close Q3 up 5.77% from the end of Q2.

Q4

In a disappointment to bulls, the rally failed to beat its last major peak before finding a ceiling on October 3. This seemed to place a nail in the coffin of attempts to revive the Q2 uptrend.

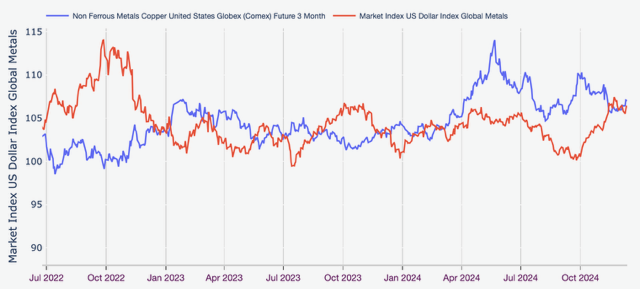

Markets widely viewed Chinese stimulus efforts as disappointing, while concerns over supply shocks evaporated as the port strike concluded (until January) after only three days. Meanwhile, the U.S. dollar remained strong despite the Fed’s pivot, with no meaningful indication it was on the verge of a downtrend.

The November election of President Trump and the expectation of increased trade barriers seemed to offer additional support to the U.S. dollar index, adding further weight to copper prices.

As of December 13, copper prices fell 8.14% since the close of Q3, making Q4 the worst-performing quarter absent a year-end spike. Despite the bearish quarter, copper prices remained 7.66% higher than where they closed 2023.

Are you properly prepared for copper contract negotiations? Be sure to check out our 5 best practices.

Mixed Market Signals Await 2025

2025 will arrive alongside several mixed market signals. China continues to tease more stimulus, but few believe China can meaningfully address structural issues like its aging population and moribund property sector, which has led to increased unrest due to the country’s economic problems.

Meanwhile, President Trump is expected to unravel subsidies for EVs and wind towers. Although infrastructure and renewable efforts will likely gain momentum due to the current administration’s efforts to allocate Federal Funds ahead of the next term, a shift in energy policy will force investors to recalibrate demand expectations. What will this mean for copper prices in 2025? Read MetalMiner’s Annual Outlook, with forecasted price ranges and contracting strategies for the new year.

Biggest Copper Price Moves

- Korean copper strip prices witnessed the only increase of the overall index, with a modest 1.57% rise to $11.39 per kilogram as of December 1.

- Chinese copper scrap prices fell 4.89% to $10,196 per metric ton.

- Chinese copper wire prices retraced to the downside, with a 4.96% decline to $10,208 per metric ton.

- LME primary 3 month copper prices dropped 5.59% to $8,974 per metric ton.

- Chinese copper wire scrap prices declined by 6.36% to $9.371 per metric ton.

[ad_2]

Source link