[ad_1]

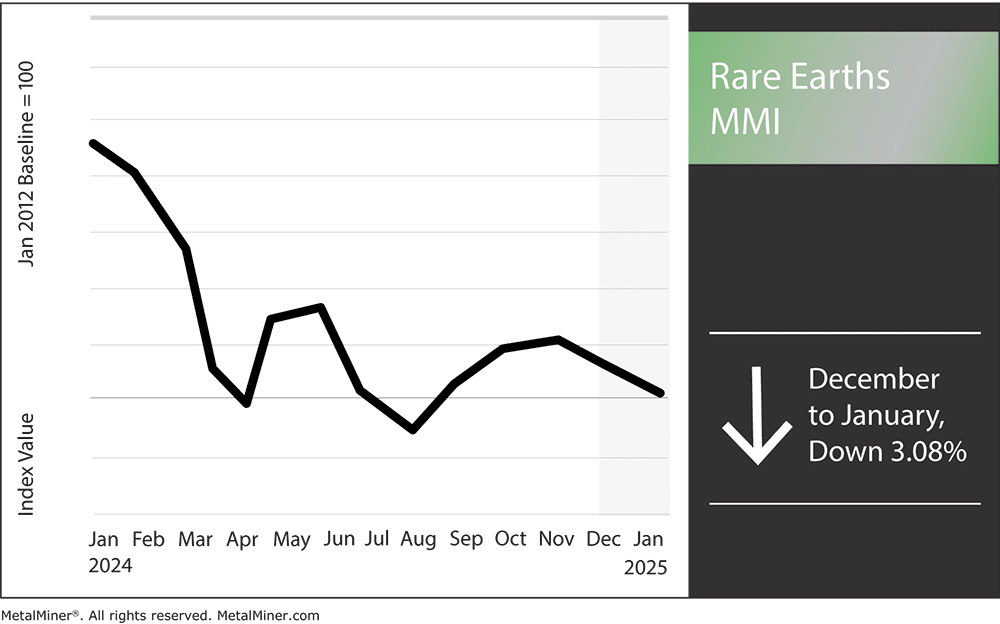

The Rare Earths MMI (Monthly Metals Index) displayed bearish sentiment as it entered 2025, dropping by 3.08%. Weak Chinese demand for metals across the board had at least some impact on the downward direction of the index month-over-month. Considering major changes are underway in the global rare earth industry, this created downward short-term price pressure.

As far as the U.S. is concerned, the incoming Trump administration could impose tariffs that would impact any raw materials imported from China, which could potentially raise U.S. rare earth prices in the long term. China’s export ban on gallium, germanium and antimony also went into full effect in December, adding additional volatility to the rare earths market.

Don’t let volatile rare earth markets catch you off guard. Sign up for MetalMiner’s free weekly newsletter and gain access to timely insights on the latest rare earth market trends and pricing.

The Trump Transition

The inauguration of President Donald Trump in January 2025 signals a transformative period for U.S. trade policies. Rare earths are indispensable in manufacturing high-tech products, including smartphones, electric vehicles and advanced defense systems. The administration’s proposed strategies are poised to influence both the pricing and import dynamics of rare earths in the U.S.

Rare Earths and Trump: Challenges

Introducing tariffs on Chinese goods is central to President Trump’s trade policies. Reports suggest that the administration is exploring imposing a 60% tax on imports from China and a 10% tax on goods from other countries.

The strategy emphasizes safeguarding sectors tied to economic stability and national defense. According to Reuters, such tariffs could push overall rates to levels unseen since the Great Depression, posing significant risks to supply chains dependent on rare earth elements from China.

China currently dominates the global rare earth market, accounting for around 70% of total supply. In response to U.S. trade measures, China has signaled the possibility of utilizing its foothold on the industry to limit rare earth exports to the United States. According to MarketWatch, such a move could result in supply disruptions and drive up costs for U.S. sectors reliant on these essential materials.

Opportunities

The Trump administration has also indicated plans to lessen reliance on Chinese rare earth imports by strengthening domestic production capabilities. According to Newsweek, this strategy involves backing U.S.-based mining and processing initiatives, which could improve supply chain resilience while generating employment opportunities nationwide.

Meanwhile, partnerships with allied nations that have access to rare earth resources, like Australia, are likely to persist. For example, Australian firm Lynas Rare Earths has already partnered with the U.S. Department of Defense to develop a processing plant in Texas with the goal being to reduce dependency on Chinese supply chains.

Market Implications

The combination of higher tariffs and initiatives to expand domestic production presents a complicated outlook for rare earth pricing in the U.S. The tariffs could initially raise costs by disrupting existing supply chains.

However, if domestic production efforts prove successful, they may eventually stabilize or even lower prices by reducing dependence on imports. That said, the adjustment period will likely see significant market volatility as these new policies and production capabilities take shape.

Rare Earths MMI: Noteworthy Price Shifts

MetalMiner’s monthly free MMI report gives monthly price trends for 10 different metal areas, including copper, stainless, aluminum and rare earth metals. Sign up here!

- Neodymium prices dropped by 3.97%. This left prices at $55,471.58 per metric ton.

- Cerium oxide prices rose by a considerable 6.45%. This brought prices to $1,045.66 per metric ton.

- Dysprosium oxide prices dropped by 4.9% to $216.40 per kilogram.

- Rare earth carbonate prices traded flat, remaining at $5,124.40 per metric ton.

- Lastly, praseodymium oxide prices moved sideways, dropping by 2.52% to $58,008.08 per metric ton.

[ad_2]

Source link