[ad_1]

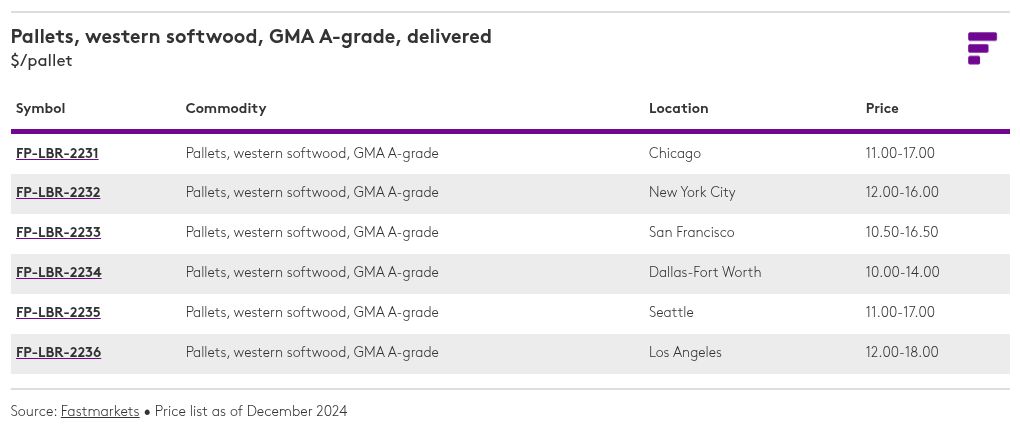

As 2024 came to a close, seasonal retail demand left only a small mark on pallet prices for December, with prices remaining unchanged compared to the previous month in Seattle, San Francisco, Los Angeles and Dallas-Fort Worth.

Looking ahead to 2025, looming port strikes in January are set to have far-reaching consequences for the US economy, alongside President-elect Trump’s planned tariffs on China, Mexico and Canada. The three countries represent a significant share of US imports, and even partial implementation of the proposed tariffs could disrupt supply chains and amplify inflationary pressures.

This month’s edition of the newsletter includes:

- Insights into the impact of last-minute holiday retail demand on the price of western softwood, GMA A-grade pallets in key areas

- An exploration of how potential port strikes on the East Coast could have a ripple effect across the industry

- Forecasting on how the pallet market will react to tariffs set to be imposed on some major US trade partners

- Details on how our pallet coverage will be improving and expanding in the months ahead

US pallet price trends

The US pallet market closed the year with solid, but unremarkable seasonal retail demand supporting recent trading ranges.

Fastmarkets again assessed Pallets, western softwood, GMA A-grade delivered Seattle at $11.00-17.00 per pallet on December 25, unchanged from the previous month. San Francisco, Los Angeles and Dallas-Fort Worth prices remained unchanged as well.

Meanwhile, Chicago and New York seem to have benefited from the last-minute holiday retail push with both markets reporting a slight supply-driven uptick in delivered prices.

Notably, New York was capped at the top end of the range by steep competition from the used sector, alternative pallet specs, and hardwoods. Fastmarkets assessed Pallets, western softwood, GMA A-grade delivered New York at $12.00-16.00 per pallet on December 25, narrowing up $1.00 from the low end of the last month’s range.

Fastmarkets assessed Pallets, western softwood, GMA A-grade delivered Chicago at $11.00-17.00 per pallet on December 25, an increase of $1.00 to both the low and the high of last month’s range. With a diminished hardwood sector, both markets seem more vulnerable to supply shortages as of late.

With the holiday retail demand uptick over by the end of the month, producers turned their attention to 2025. Opinions on next year varied. While many were optimistic that the new Presidential administration would bring some welcome economic relief – question marks about the impact of potential tariffs, the overall state of the economy and the glut of used pallets lingered.

Looking forward to next year, Fastmarkets will be proposing changes to our pallet definitions and expanding our coverage of the pallet marketplace. While some producers market their new construction pallets as either “#1” or “Grade A,” based on feedback collected over the last several months there is a growing consensus that “Grade A” more is commonly utilized to specify a top quality “used” pallet as opposed to a “new” pallet.

That being the case, Fastmarkets will be proposing a change to our definitions to more clearly specify the existing price specification as “new GMA.” Additionally, we are happy to report that next year we will also be launching “used GMA Grade A” and “used GMA Grade B” prices. More details will be available soon.

As Fastmarkets ramps up its coverage of the pallet market, we invite feedback on specific pallet-related items for future reports. Contact ian.templeton@fastmarkets.com with comments or to contribute future pricing information.

Port strikes loom: Ripple effects on pallet supply chains and inflation

The upcoming expiration of the International Longshoremen’s Association (ILA) contract on January 15 could signal the start of a prolonged East Coast port strike, with far-reaching consequences for the US economy. The October strike was merely suspended, and the cooling-off period is nearing its end. Should the strike resume, it could paralyze supply chains, causing shortages that idle factories and inflate prices. In October, even a brief ILA strike led to 100,000 containers piling up in New York alone, according to Reuters.

President Biden previously declined to invoke the Taft-Hartley Act to force workers back on the job, and Trump’s latest comments suggest he would take a similar stance. After meeting with the President of the ILA and publicly voicing his support on the key issue of automation, Trump criticized the US Maritime Alliance (USMX), stating, “Foreign companies have made a fortune in the US by giving them access to our markets. They shouldn’t be looking for every last penny knowing how many families are hurt.”

Without intervention, ripple effects are likely, including inflationary pressures that could keep interest rates high into 2025, suppressing housing starts and tightening the low-grade lumber supply. This would create upward pressure on lumber prices, further impacting downstream markets like pallets.

Adding to the complexity, the National Retail Federation and 266 other trade associations are urging the ILA and USMX to resume negotiations before the deadline. If no agreement is reached, the resulting supply chain disruptions could result in a textbook bullwhip effect as the strike temporarily increases pallet demand due to front-loading, only to see demand fall once trade normalizes and the likely imposition of tariffs depress overall trade volumes.

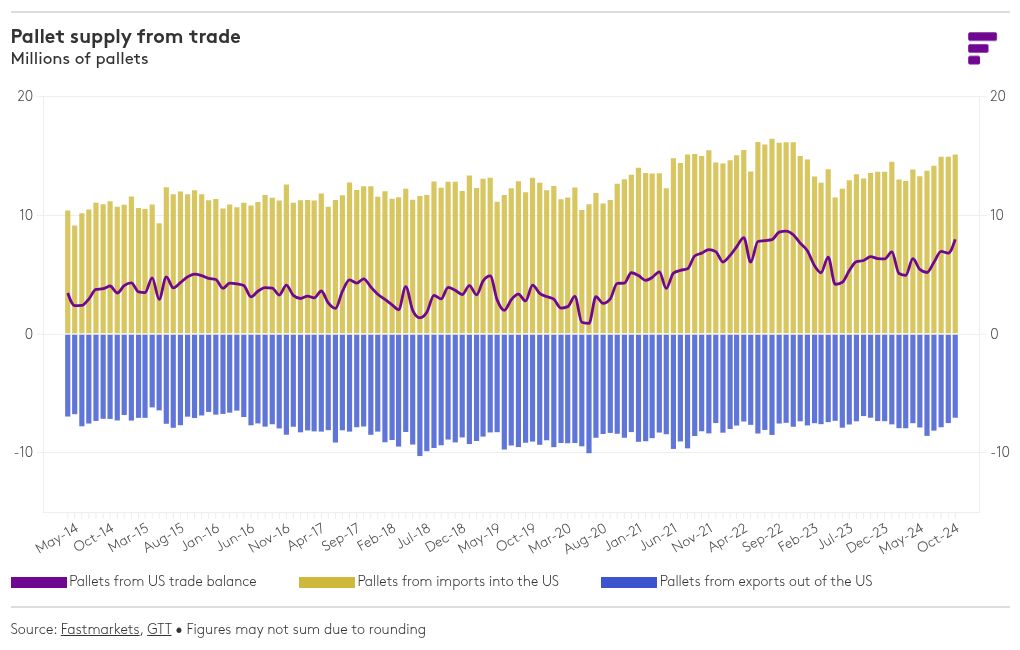

Here we see a similar, although less pronounced, scenario already took place in the lead-up to the first strike, before it was suspended. Between June and October 2024, net US trade in pallets increased 54% as retailers decided to front-load in the months leading up to the strike.

Economic uncertainty amidst tariff talk and inflation worries

The looming Trump tariffs on imports from key trading partners add another layer of uncertainty to the US economy. China, Mexico and Canada – three countries Trump has explicitly picked out for tariffs – represent a significant share of US imports, and even partial implementation of the proposed tariffs could disrupt supply chains and amplify inflationary pressures.

Consumer surveys reflect growing anxiety: in the University of Michigan’s monthly survey of consumers, a quarter of Americans believe it’s a good time for major purchases in anticipation of higher prices next year, while one-third of respondents in a CreditCards.com survey admitted they are accelerating purchases to avoid tariff-driven costs.

In the broader economy, mixed signals make forecasting particularly challenging. Inflation has not cooled enough to reach the Fed’s 2% target, with stubborn pressures remaining, especially in services.

While goods inflation appears under control, services inflation could stay “sticky” into 2025, complicating the Federal Reserve’s monetary policy decisions. After the rate cut on December 18, the Fed is projected to pause further cuts next year, citing lingering concerns over inflation, trade wars and tariffs. Sticky inflation, coupled with trade uncertainties, could keep mortgage rates elevated, dampening housing market activity and suppressing demand for low-grade lumber.

The PCE price index, the Fed’s preferred inflation measure, showed only modest increases recently, with a 0.1% rise in October and a 2.4% annual rate—below expectations. However, the Fed’s latest summary of economic projections reflects caution, forecasting just two additional rate cuts for 2025 instead of the four expected earlier, a nod to the economy’s resilience but also its persistent inflationary challenges.

Despite these headwinds, there are reasons for cautious optimism. Seasonally adjusted credit card delinquency rates fell in Q3 to 3.23 percent, down from 3.24 percent in Q2, representing the first decline in delinquency rates since 2021. Moreover, productivity growth remains strong, supported by advancements in artificial intelligence, and investors still see the US as an attractive place to invest compared to the rest of the world, which is buttressed by strong GDP growth.

Lessons from 2018 trade tariffs

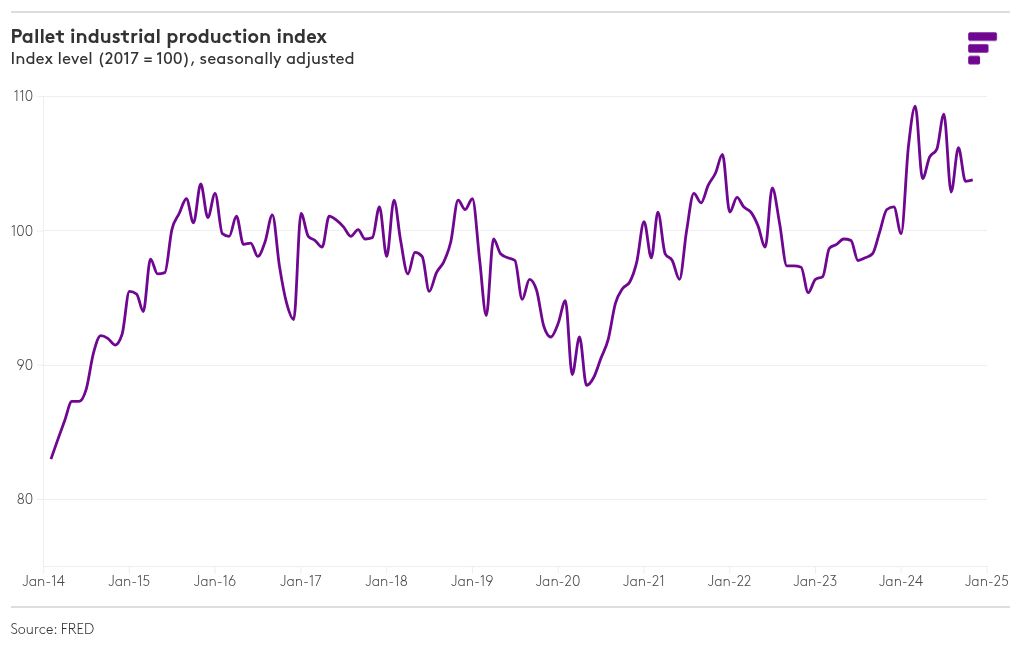

The Pallet Industrial Production Index provides a useful lens to evaluate the impact of tariffs and other macroeconomic events on the industry. Notably, the index fell sharply following the implementation of the 2018 tariffs during the US-China trade war. The enforcement of these tariffs began in July 2018 and affected a substantial volume of goods traded between the two nations.

In anticipation of these tariffs, many importers engaged in front-loading to expedite shipments into the US, temporarily boosting trade activity and driving up freight rates. However, once the tariffs were in place and the initial surge subsided, there was a noticeable decline in the index. This drop underscores the downstream effects of trade policy on the pallet market, as the reduced flow of goods directly impacted demand for pallets used in transportation and storage.

More recently, we’ve seen a more erratic industrial production index which hasn’t been able to settle due to conflicting market forces such as declining housing starts but increased demand for retail goods.

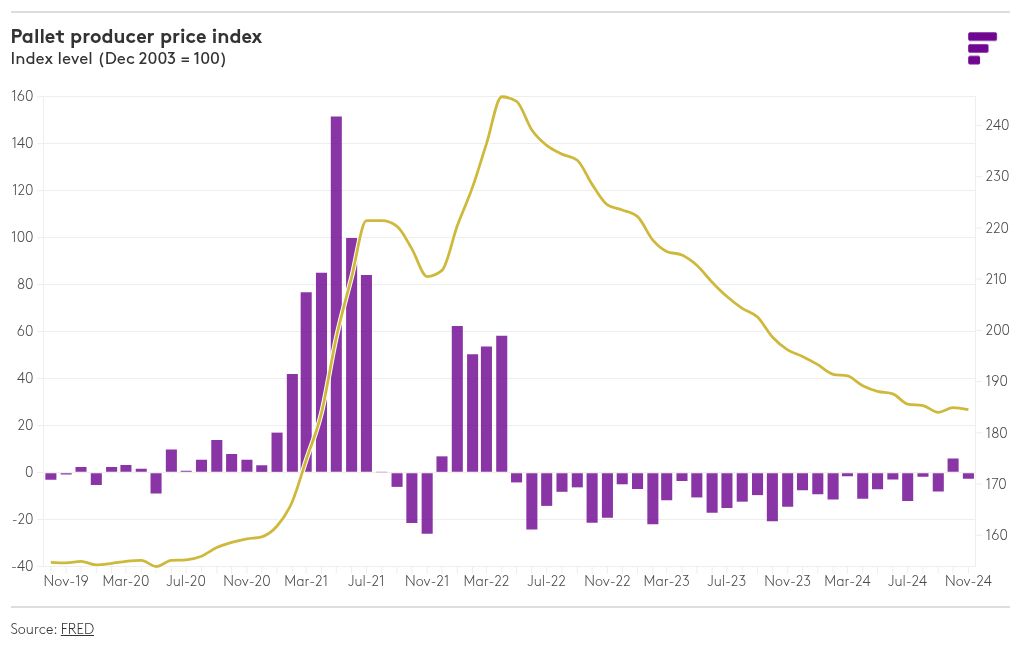

Pallet prices softly affected due to 2018 tariffs

In addition to the aforementioned Pallet Industrial Production, here we can also see how the 2018 tariffs impacted the Pallet Producer Price Index. While industrial production showed a notable decline as producers anticipated reduced demand, this fall in production effectively offset the lower pallet demand. As a result, pallet prices remained relatively stable despite the disruptions in the broader economy. This materialized through two short sudden bumps in Q3 of 2018 and Q1 of 2019 before prices remained stable until we saw the effects of the pandemic impact the market.

Prices have once again begun to stabilize after the highs of 2021 and 2022, but we anticipate that in conjunction with the effect of the ILA strike, prices will see a bump at the start of 2025 before declining again at the end of the year once there’s more certainty around the tariffs.

Chicago, San Francisco and Los Angeles see divergence in #3 and #4 grade lumber prices

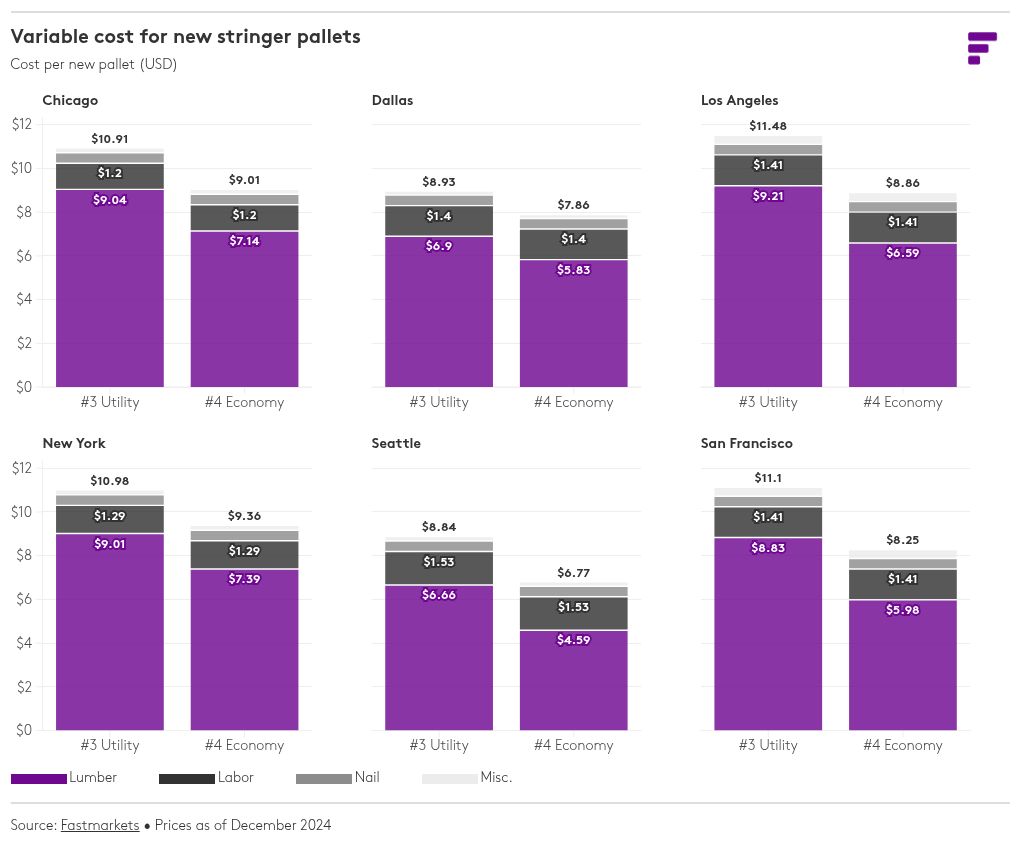

As we continue rolling out our cost model, we’re providing detailed insights into the gross variable cost of producing a new western softwood GMA A-grade stringer pallet across six key metro hubs. This model highlights a side-by-side comparison of costs depending on whether #3 or #4 grade lumber is used in production.

The model is based on the availability of softwood lumber and takes into consideration the delivery cost from the mill to the pallet facility, which is partly why we see a lower cost in Seattle and a slightly higher cost in Chicago.

We must caveat that while certain manufacturers will have lower costs due to a higher utilization of automation, these are our estimated averages for each of the metro hubs.

Moreover, the total cost for each hub is calculated by adding the lumber cost and labor cost, which are labeled for each metro hub, alongside a nail cost that is uniform across the country, and miscellaneous costs, including smaller items such as gas, electricity, paint and staples.

An emerging trend has been the larger spread between #3 and #4 grade lumber for the metro hubs of Chicago, San Francisco and Los Angeles, which will see some more replacement of #3 grade lumber pallets.

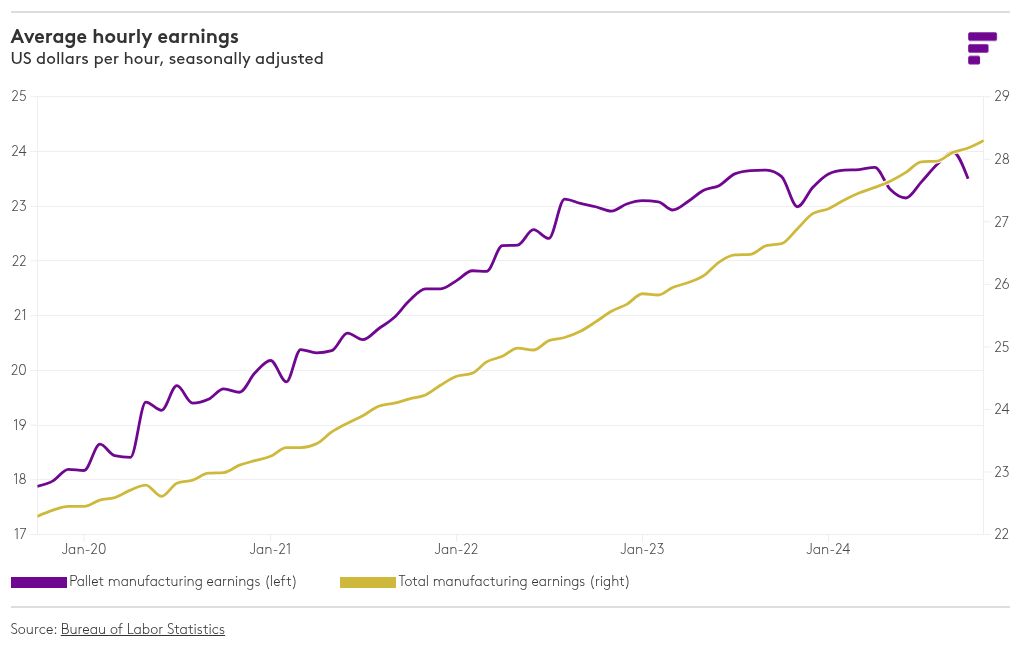

Slowing wage growth amid declining demand and rising automation

The pallet manufacturing sector has experienced a notable slowdown in wage growth over the past two years, a shift driven by declining pallet demand and increased automation. While wages previously outpaced those in the broader manufacturing sector, this trend has moderated as automation technologies, such as robotic dismantlers and AI-powered inspection systems, have reduced the reliance on manual labor.

With automation improving efficiency and lowering costs, companies have been able to streamline operations, mitigating the need for additional labor. Combined with softer demand for pallets in recent years, these factors have curbed upward pressure on wages, signaling a changing labor dynamic in the pallet industry.

As Fastmarkets expands its coverage of the pallet market, we invite feedback on our analysis and insights. Contact antonio.gallotta@fastmarkets.com with comments.

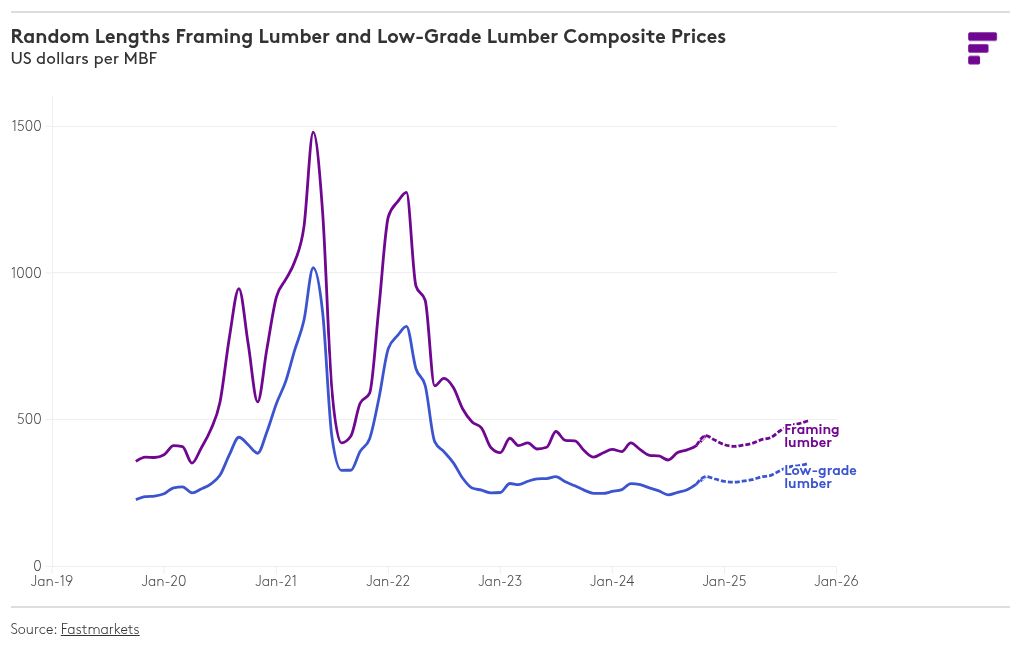

Framing and low-grade lumber prices continued their climb

As we’ve mentioned in previous editions and shown by the two indices having a high correlation, we also incorporate framing lumber into our analysis as it’s long been a leading indicator of low-grade lumber. November prices for both continued their rally seen in October, although prices across all of December are likely to fall as we usually see a decline in construction with the festive period and colder weather encroaching on productivity.

The Random Lengths FLCP averaged $445 per MBF in November, the highest since July 2023, which we forecast to fall slightly in Q1 2025 and stabilize before beginning to accelerate at the end of the year. We see this effect trickle down to low-grade lumber prices which similarly saw a bump to $306 per MBF in November, which equivalently is also the highest since July 2023.

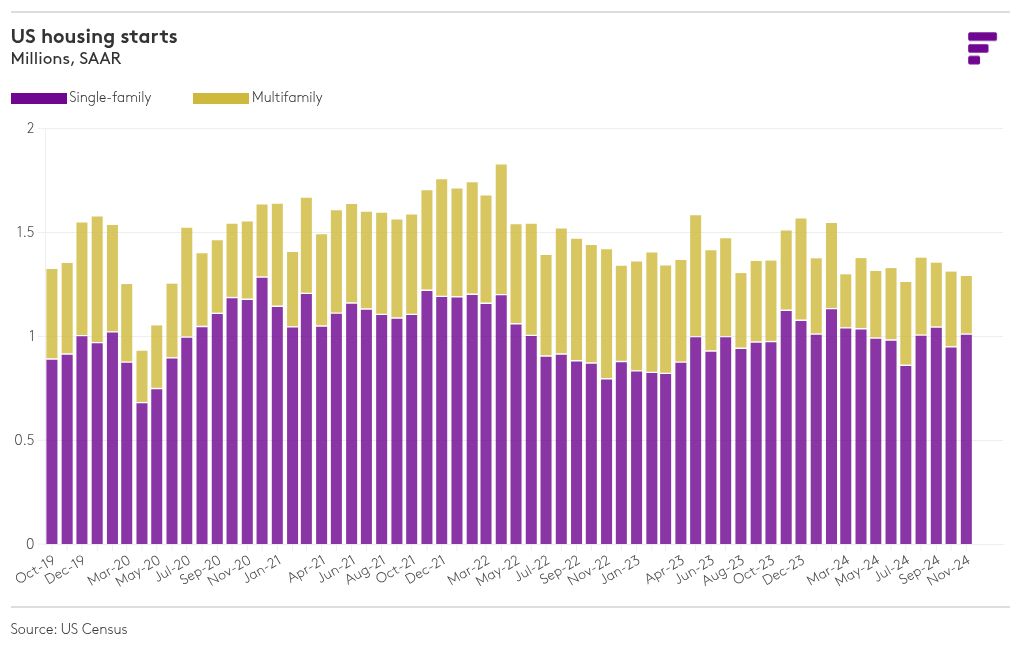

Housing market resilience amid mixed economic signals

The US housing market displayed resilience in November, with single-family housing starts rising by 6.4%, even as total housing starts declined due to a sharp drop in multifamily activity. Permits painted a more optimistic picture, climbing 6.1% month-over-month to 1.505 million units, driven primarily by multifamily permits. Regionally, total starts increased in the Northeast and South, while declines were observed in the North Central and West.

Despite affordability challenges stemming from high mortgage rates, single-family permits and starts remain steady, reflecting underlying demand for housing. However, the interest rate environment continues to weigh heavily on the housing sector. With inflation still above the Fed’s 2% target and only modest signs of cooling, federal policymakers are expected to proceed cautiously with rate cuts. As mentioned above, the Fed has signaled just two additional 25-basis-point cuts for 2025, reinforcing the likelihood that mortgage rates will stay elevated, limiting the potential for significant growth in housing activity.

While the broader macroeconomic environment provides mixed signals, the sustained strength in single-family permits and starts suggests a degree of resilience in the housing market. However, with persistent inflationary pressures and elevated borrowing costs, the path to a more robust housing recovery becomes harder.

[ad_2]

Source link