[ad_1]

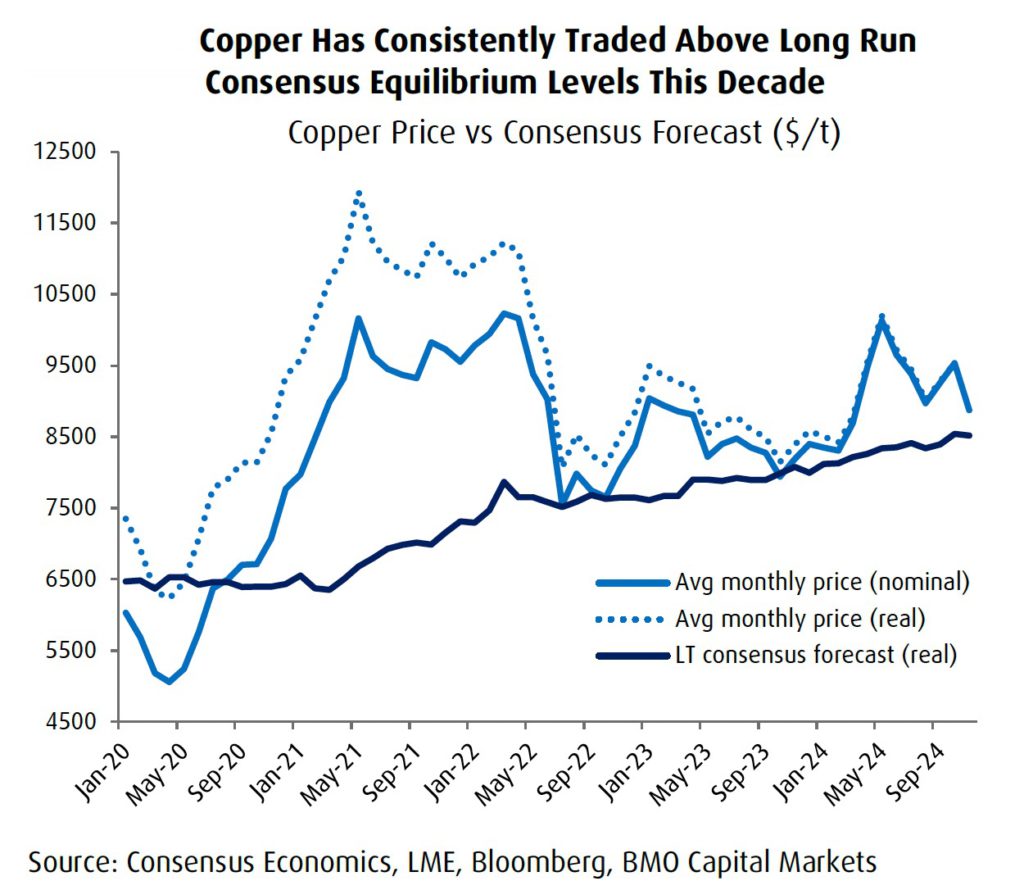

In May, Comex copper hit an all-time intraday high of nearly $5.20 a pound or $11,500 per tonne. Positioning went to such net lengths that dollar trading volumes scaled $100 billion (twice the Dow daily average) in one 24 hour period.

Cooler heads prevailed in London, particularly after it became clear that the squeeze was mainly a US phenomenon and cargoes destined for Rotterdam and Shanghai were soon redirected there. LME futures have yet to visit $11,000 a tonne.

Copper is the new oil

A supposedly never-wrong oil hedge fund manager from France – that bastion of the commodities world – took a pause from the black stuff to forecast $40,000 a tonne for the brown metal over “the next four years or so”.

Perhaps fitting since even those with decades of experience on metals markets got caught up in the excitement, calling copper “the new oil,” the “highest conviction trade ever seen” and predicting a 50% price upside.

But like the head on a badly poured French Blanche the froth on copper markets soon settled.

Managed money longs made another big push at the end of September, this time predicated on a Beijing bazooka of economic stimulus, but the subsequent run up for copper fell well short of what was promised just like the pronouncements of the Standing Committee of the National People’s Congress.

The final blow for copper’s year of living gloriously was Trump’s tariffs and a stronger dollar and it now looks like copper will drift into the new year with most of its 2024 gains given up.

But what’s in store for 2025?

While futures are fun to follow, on and under the ground developments unfold at a slower pace – although even here surprises could be plentiful.

How brown is your valley

Copper markets took the loss of Cobre Panama mostly in stride thanks to Codelco managing to run fast enough to stand still.

Escondida, the only 1mtpa plus copper mine in the world, is also churning out metal with the latest production figures showing a 22% year on year jump, helping to lift overall Chilean output more than 6% compared to last year.

Chile’s mining association said this week copper production will range between 5.4m and 5.6m tonnes in 2025.

While major greenfield mines coming on stream is increasingly fewer and farther between with Malmyzh in Russia (120ktpa) the only entry for 2025, expansions at Almalyk in Uzbekistan (148ktpa), Kamoa Kakula (139ktpa), and QB2 in Chile, Peru’s Las Bambas in Mongolian Oyu Tolgoi each close to 80ktpa will ensure fresh supply in 2025.

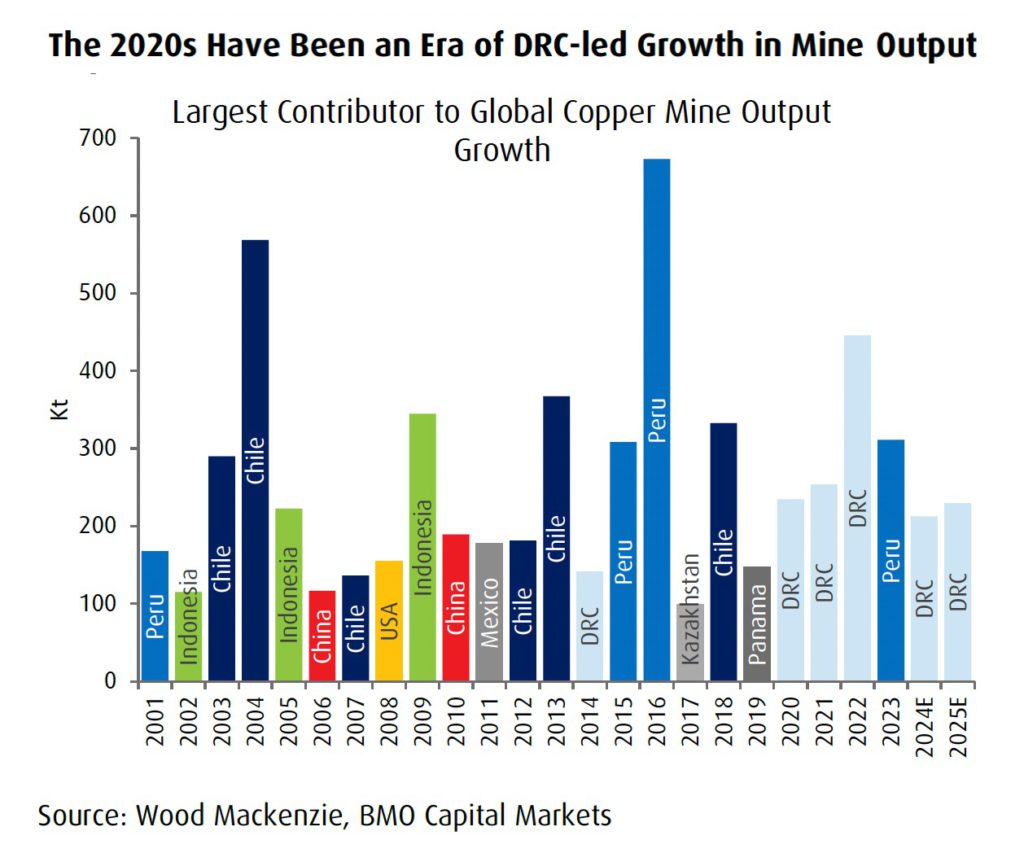

Congo contribution

With CMOC’s Tenke Fungurume and Kisanfu firing on all cylinders and ever dependable Kamoa’s contribution the DRC is likely to be once again responsible for the most additional tonnes next year as it has for the past four out of five years.

The last time the US was the greatest contributor was 2008, but the incoming Trump administration positive noises around permitting may see the country once again play its part on copper markets some time in the future.

Copper markets will remain well supplied in 2025 says BMO and at around 2.8% growth will be higher relative to recent history. Macquarie thinks output could rise by as much as 4% in 2024 and with project approvals of nearly 500kt so far in 2024, the pipeline further out may not be as thin as previously thought.

Of grid

On the demand side, the backdrop of the energy transition and the rosy long term outlook for copper is very much still in place, but day-to-day it is still all about China as evidenced by the immediate response of fiscal or monetary stimulus on markets.

Overall China is responsible for around 56% of global copper consumption or around 15mt and Capital Economics in a recent research report argued that a correction in Chinese construction activity “as large as 50% decline from peak to trough” will offset most of the electrification demand.

RBC Capital Markets expects global copper demand growth of 2.9% year-over-year in 2025 with the bulk of the growth coming from outside China which will only expand by 1%.

BMO Capital Markets are more optimistic modelling 2.2% growth in China next year. Next year’s state grid budget (spending surged in 2024 by more than 20% to over $400bn) will be a factor in Chinese demand but there is consensus that the construction slump, particularly for completions, will continue to be a drag.

Getting the treatment treatment

The all-time low benchmark treatment charges of $21.25/t (the benchmark was $80/t last year and spot TCs even went negative for several months this year) agreed between Antofagasta and Jiangxi last week lifted spirits but as many have pointed out it’s a sign of smelter overcapacity not demand for concentrate.

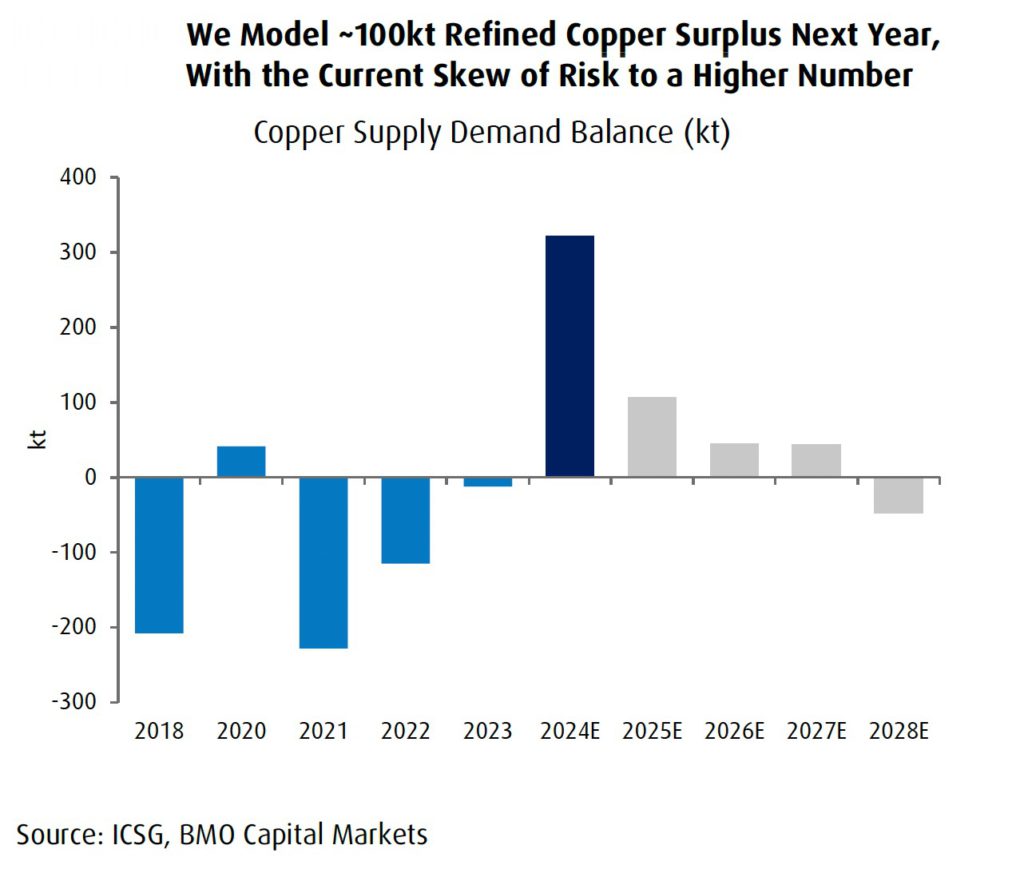

After promised supply cuts from Chinese refiners did not materialize 2024 turned out to be the largest (refined) copper surplus in over a decade. BMO predicts a much smaller surplus this year of around 100kt. RBC sees around half that while Macquarie is most pessimistic with a refined surplus three times BMO’s (but a deficit on concentrate markets).

Macquarie also points to the wild card for copper market over the next few years: “Should the Cobre Panama mine restart, and we believe it ultimately will, then there is the potential for an additional 300ktpa of mine supply which would keep the market in a comfortable surplus out to 2029 (all else being equal).”

The price is right?

Goldman Sachs, the copper uber bulls of the last few years, took a chainsaw to its price forecast but even after cutting by $5,000 is still one of the more optimistic prognosticators. The investment bank sees copper averaging $10,160 a tonne next year.

Morgan Stanley forecasts prices will climb to $9,500 by the end of 2025. The Chile mining association is also one of the more sanguine at between $9,260–$9,920, but CitiGroup recently slashed its expectations from an average of $10,250 to $8,750 next year.

RBC lowered its 2025 estimate to $8,800 (from just under $10,000 before), while BMO’s prediction for next year is also for copper to camp out around the $4.00 or $8,800 level.

Capital Economics is the most pessimistic forecasting copper would lose touch with the $9,000 a tonne level next year, average only $8,000 by the end of 2026, and continue to drift lower through 2030.

[ad_2]

Source link