[ad_1]

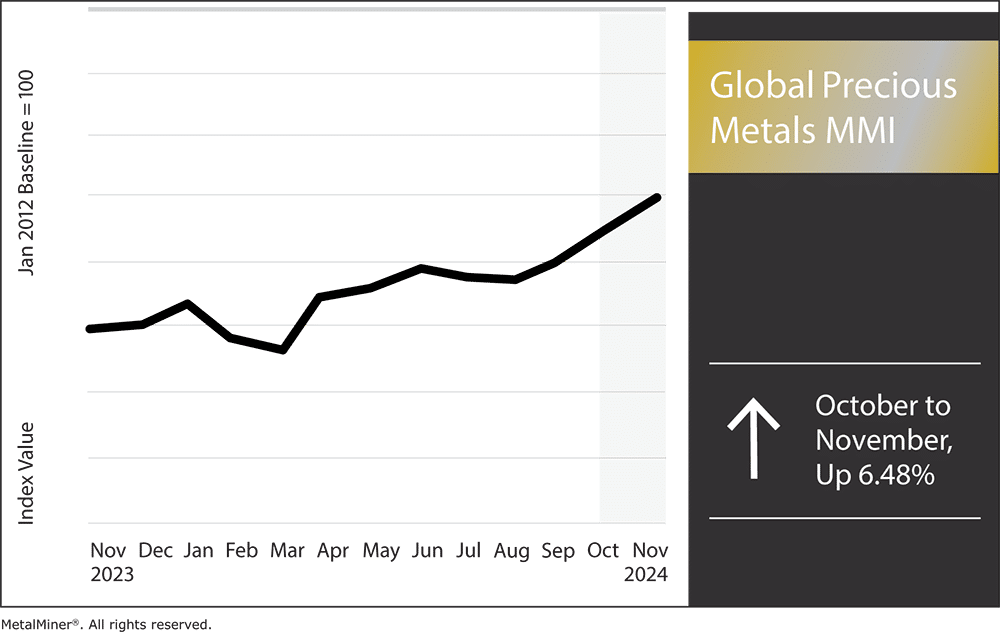

The Global Precious Metals MMI (Monthly Metals Index) witnessed considerable bullish sentiment once again. Month-over-month, the index rose 6.48%. After the election, precious metals prices quickly responded to the outcome and the expected policy directions of the new Trump administration. While the index had been rising in the prior two months, prices began to decline once the election results came in.

The U.S. dollar index also began dropping post-election, adding bearish sentiment to precious metals post-election. This downward trend will likely continue in the short term.

Want monthly price trends for 10 different metal industries? Sign up for MetalMiner’s free MMI report.

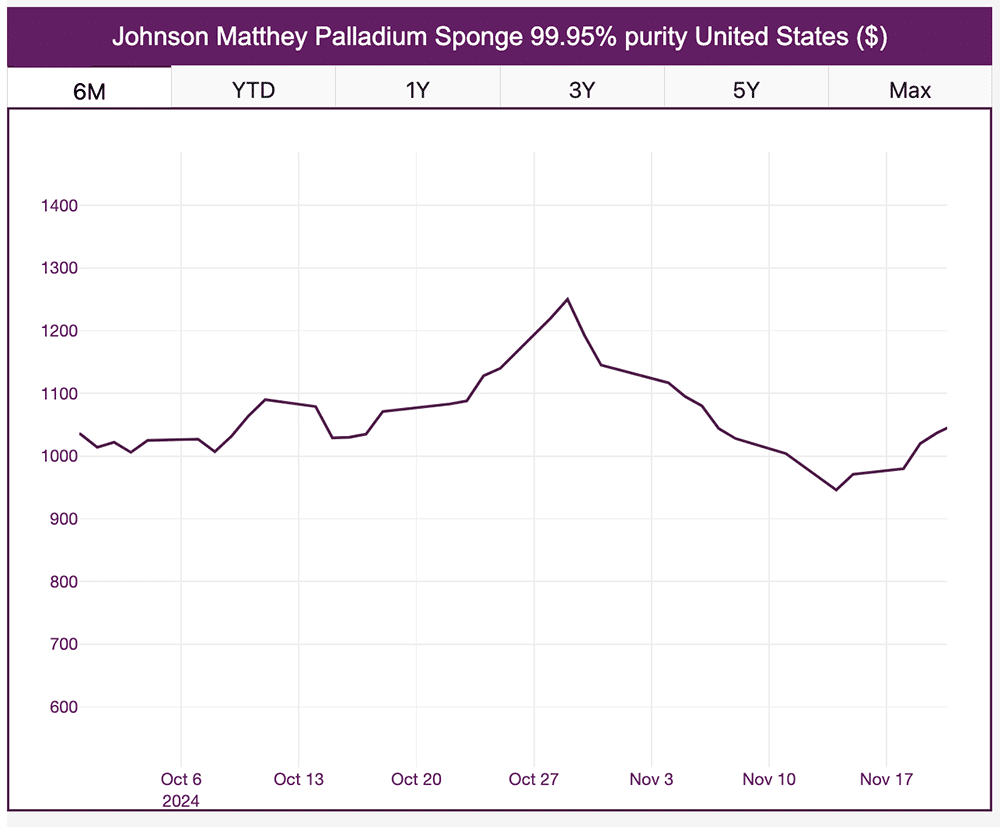

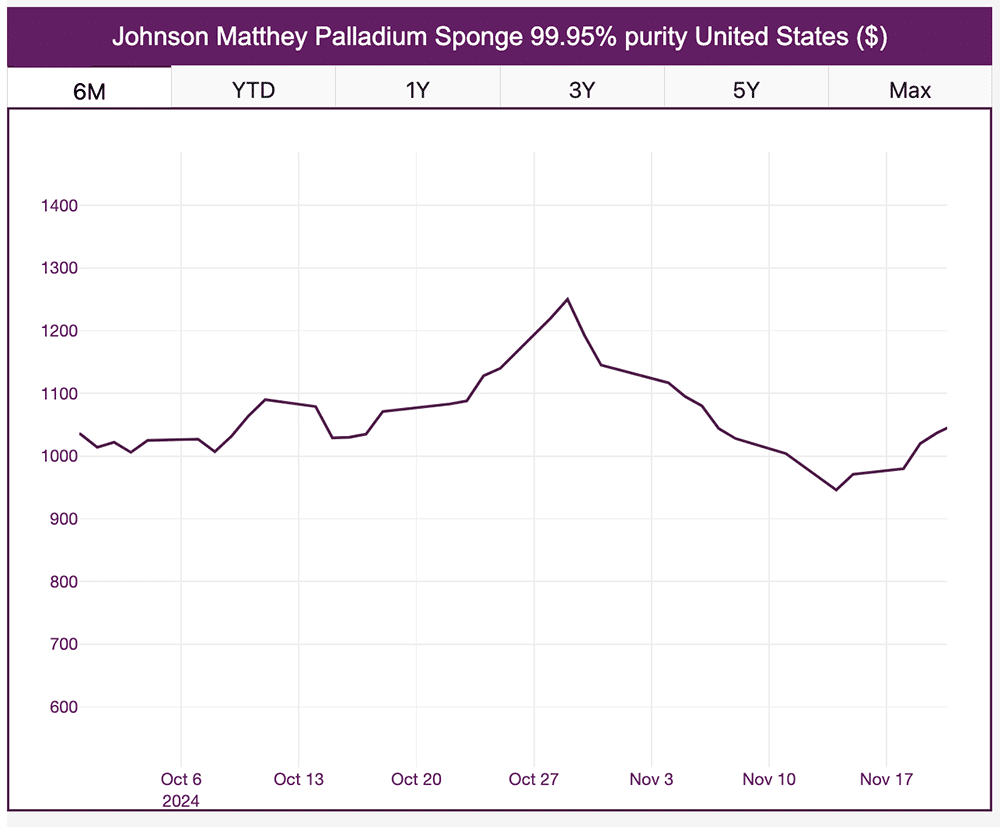

Palladium Prices Dips Below Support Line

Palladium prices surged in late October. However, they fell to a nine-week low by early November. This decline mainly stemmed from the rising strength of the U.S. dollar and concerns over potential new tariffs from the Trump administration, which might disrupt international trade and lower demand for palladium. A stronger dollar raises the cost of dollar-priced commodities for foreign buyers, which, in turn, dampens demand and pushes palladium prices down.

Analysts have differing predictions for palladium’s future in the near term. Some expect prices to keep falling, citing reduced demand from the automotive industry and a rise in recycled supply. Others argue that potential supply disruptions could help stabilize or even boost prices.

Precious Metals Prices: Platinum

Platinum prices dropped in late October, largely driven by a strengthening U.S. dollar and increased investor willingness to take on risk. However, platinum prices recovered by mid-November, partly due to ongoing power outages in South Africa, a country responsible for about 70% of the world’s platinum production.

Looking ahead, analysts hold differing views on platinum’s direction. While some predict further declines driven by reduced demand from the automotive industry and a growing supply of recycled material, others believe that potential supply challenges could help sustain or increase prices.

Silver Prices Dip Before Rebounding

Silver prices fell in late October, driven by the strengthening U.S. dollar and rising Treasury yields. Silver prices had recovered by mid-November, reaching over $31.32 per ounce by November 19. The softening of the U.S. dollar also played a role in the market’s fluctuations.

Some analysts predict prices could continue to rise, citing tight supply and potential further weakening of the dollar. Others believe that potential supply disruptions could help maintain or boost the price.

MetalMiner customizes price points, price forecasts and procurement solutions based on the specific metal type your company purchases. See MetalMiner’s full metal catalog.

Precious Metals Prices: Gold

Gold prices surged in late October, reaching record highs once again. However, prices fell by early November, driven by expectations of tighter U.S. monetary policy under President Donald Trump and a decrease in geopolitical danger. Analysts predict prices will continue to climb, supported by limited supply and the possibility of a weaker U.S. dollar.

Global Precious Metals MMI: Noteworthy Price Shifts

Subscribe to MetalMiner’s weekly newsletter and conquer market volatility with valuable weekly market insights and macroeconomics.

- Palladium bars rose by 13.12%, putting prices at $1,114 per ounce.

- Platinum bar prices moved sideways, rising a slight 2.04% to $1,001 per ounce.

- Silver ingot prices increased by 6.97% to $33.47 per ounce.

- Finally, gold bullion prices rose by 5.3% to $2,777.90 per ounce.

[ad_2]

Source link