[ad_1]

- Soil sampling, geological mapping and prospecting, along with initial diamond drilling of 843.7 m in 2 holes completed in Sitka’s first phase of exploration at the newly acquired Pukelman intrusive target.

- Visible gold and abundant sheeted quartz veining were observed in initial drill holes completed at the Pukelman intrusion with assays pending.

- East-Southeast trending zone of sheeted quartz veining and brecciation with visible gold identified at the Contact zone, located immediately south of the Pukelman intrusion, with surface rock samples returning up to 67.9 g/t Au.

- Sheeted quartz veining with arsenopyrite and pyrite identified on surface within the Pukelman intrusion with rock samples returning up to 1.08 g/t Au.

- 1,354 soil samples were collected in the area between the Blackjack and Eiger deposits and the Pukelman intrusion significantly extends the gold-in-soil anomaly and yields up to 1645.8 ppb Au (1.65 g/t Au).

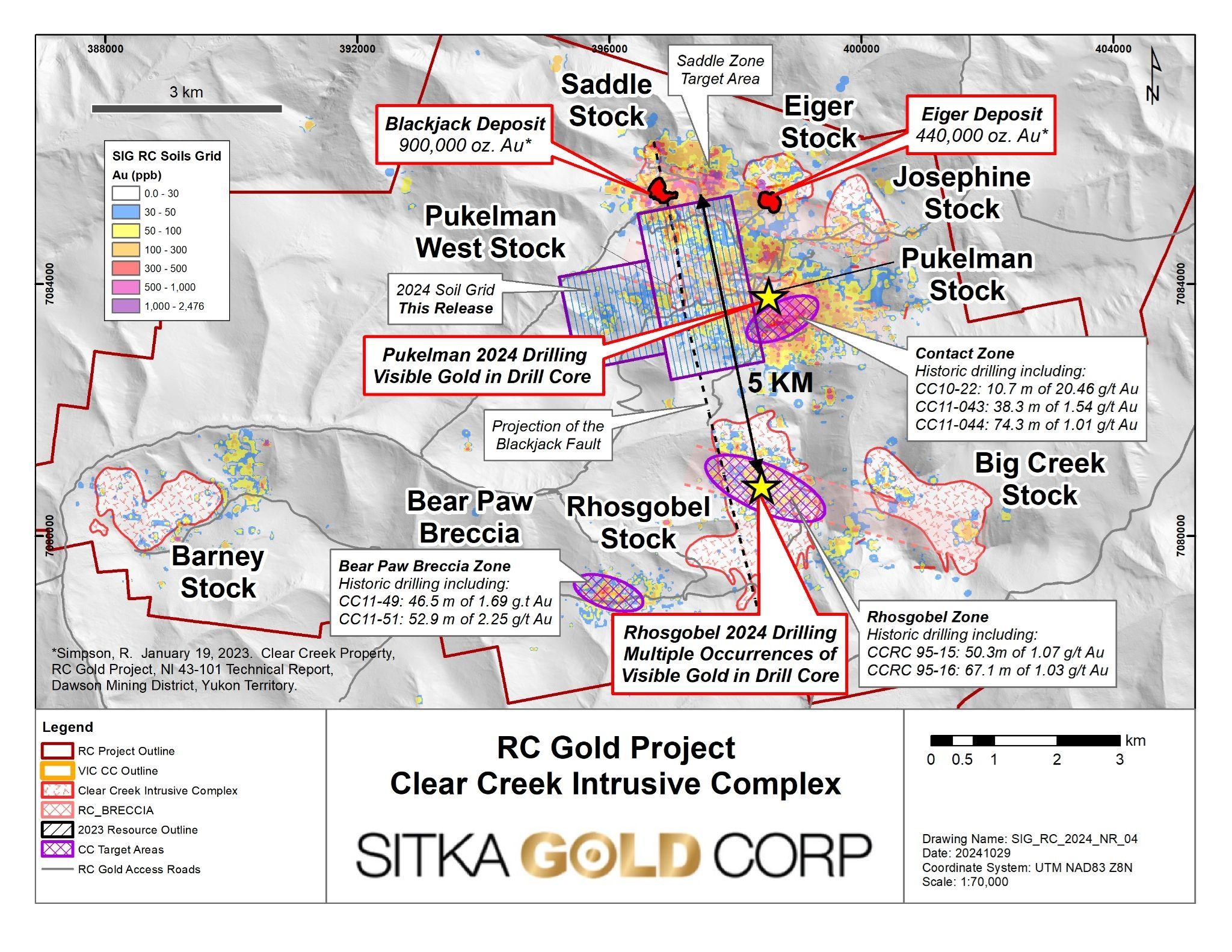

Sitka Gold Corp. (TSXV: SIG) (FSE: 1RF) (OTCQB: SITKF) (“Sitka” or the “Company”) is pleased to report on recently completed exploration at the Pukelman reduced-intrusion related gold target at its road accessible, 431 square kilometre RC Gold Project (“RC Gold” or the “Project”) located in Yukon’s prolific Tombstone Gold Belt. The Pukelman intrusion target is one of several high-quality targets located within the Clear Creek Intrusive Complex (CCIC), a cluster of known gold-bearing intrusions, which is now controlled entirely by Sitka with the recent acquisition of claims encompassing the southern portion of the CCIC (see news release dated June 24, 2024). Assay results are currently pending for recently completed diamond drilling at the Blackjack, Rosghobel and Pukelman intrusive targets (see Figure 1).

Figure 1 – A map of the Clear Creek Intrusive Complex, on the RC Project, showing the Blackjack and Eiger Deposits with relation to the newly acquired Pukelman and Rhosgobel Intrusions. Drilling is focused on testing multiple targets including Blackjack, Rhosgobel and Pukelman within this large mineralized system. Recently completed drilling within this 8 km x 15 km area at the Rhosgobel and Pukelman Stocks has encountered visible gold and intrusion-related gold mineralization in drill core, similar to that seen at the Blackjack and Eiger gold deposits (see news release dated October 9, 2024).

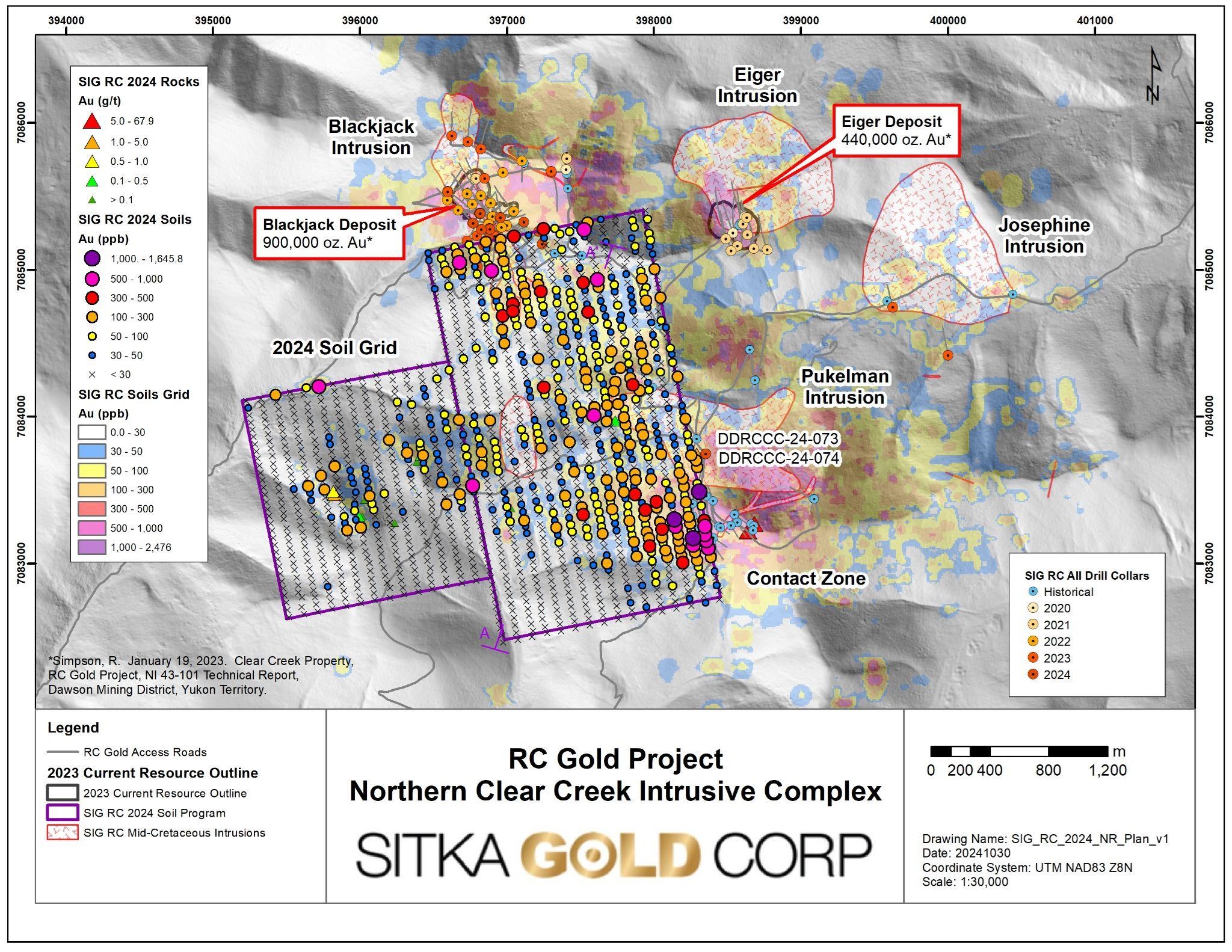

“Sitka’s initial drilling at the Pukelman target has yielded highly encouraging visuals, with visible gold observed in both the drill core and on a surface rock sample that returned 67.9 g/t gold, reinforcing the potential of this area to host strong gold mineralization,” commented Cor Coe, CEO and Director of Sitka Gold. “Since acquiring the Clear Creek property in June of this year, the Company has made impressive advances with the first ever diamond drilling at the Rhosgobel intrusion returning numerous instances of visible gold and the recent completion of two diamond drill holes at the Pukelman intrusion where visible gold has also been observed in the drill core. Additional exploration work included a large soil geochemical survey that yielded up to 1,645.8 ppb gold between the Blackjack deposit and Pukelman stock along with mapping and prospecting with rock samples returning strong gold mineralization (see Figure 3). These results underscore the potential for discovering another intrusion related gold deposit at RC Gold and we look forward to receiving the drill hole assays from Pukelman, Rhosgobel and our expansion drilling at Blackjack in the near future, with eight drill holes currently in the lab.”

Figure 2 – A map of the northern extent of the Clear Creek Intrusive Complex showing the location of the 2024 soil grid with the historical soils grid and Tombstone suite reduced intrusions. Sitka’s 2024 soil sampling has substantially expanded the gold-in-soil anomaly approximately 2.5 kilometres between the Blackjack Deposit and the Contact Zone, with strong values of up to 1645.8 ppb Au returned.

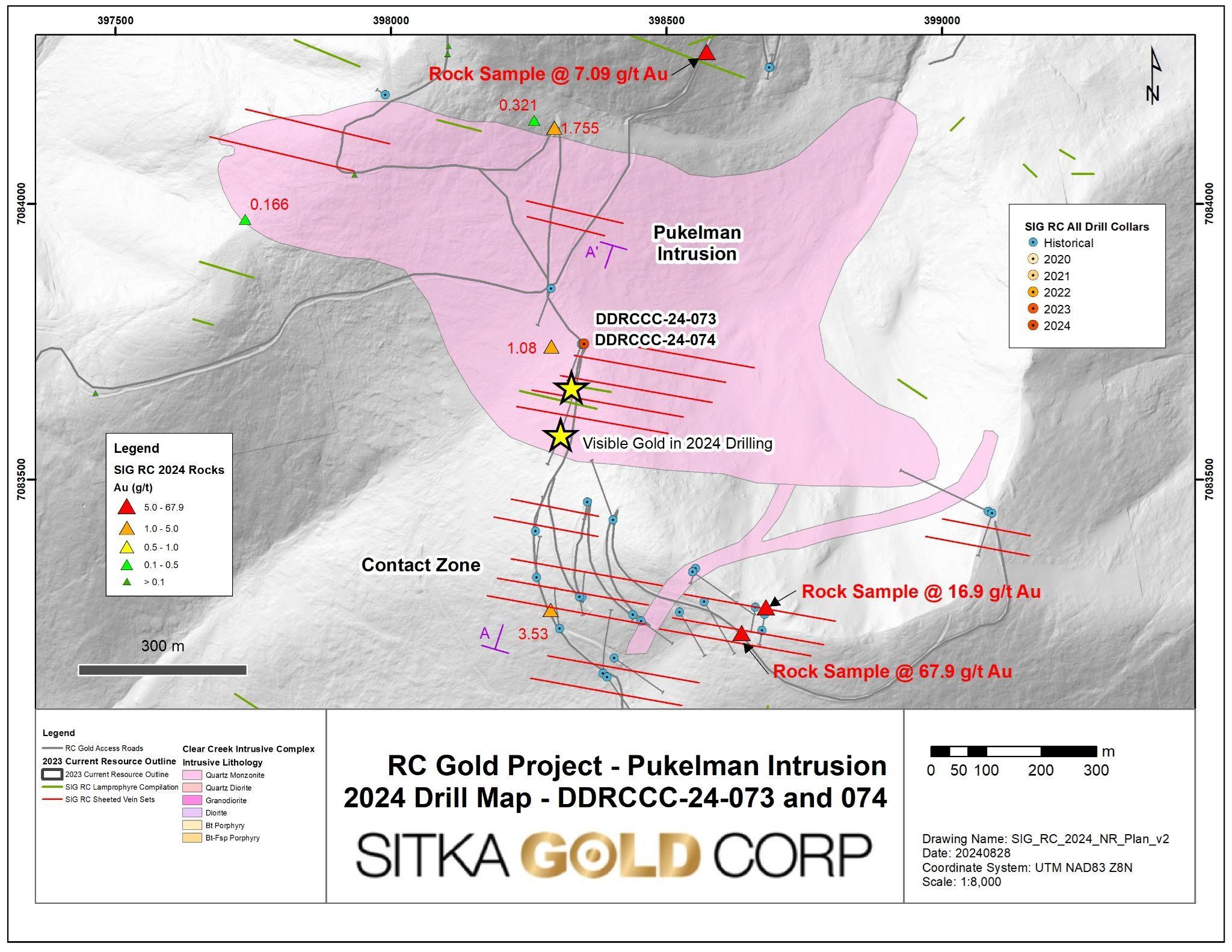

Figure 3 – A map of the Pukelman Intrusion showing the location of the 2024 drilling and surface rock sampling. Extensive sheeted vein sets along with several lamprophyre dykes have been mapped within the intrusion and within the metasediments at the Contact Zone.

Exploration on the Pukleman target in 2024 included soil sampling, limited geologic mapping and prospecting, and two diamond drill holes totalling 843.7 metres. Soil sampling was conducted to infill a gap in the historical data between the Saddle and Pukleman stocks. The samples were collected on 100 metres spaced lines with 50 metres spaced samples and targeted “C” horizon material. The samples returned values ranging from trace to 1645.8 ppb gold (1.65 g/t gold) with 149 samples returning >100 ppb gold (see Figure 2). The soils are coincident with strongly anomalous arsenic and bismuth and, when combined with historical sampling from the area, form a 3.5 km x 4 km continuous NNW trending gold in soil anomaly >50 ppb gold covering the Blackjack, Saddle, Eiger, G2, and Pukleman-Contact target areas.

Prospecting in the Pukelman target area returned values in rock samples from 0.166 – 67.9 g/t gold. One sample was collected from the central portion of the Pukleman stock from strong sheeted quartz veins in quartz monzonite intrusive with pyrite-arsenopyrite mineralization and returned 1.08 g/t gold. The zone of sheeted quartz veining trends ENE and was the target of the 2024 diamond drilling discussed below. Three samples were collected from the Contact zone approximately 430 metres south of the Pukleman stock target and returned values of 3.53, 16.9, and 67.9 g/t gold (see Figure 3). The mineralization is associated with an ENE trending zone of sheeted quartz veining and brecciation with pyrite, arsenopyrite, and, localised, bismuthinite and visible gold, within a quartz feldspar porphyry dike and adjacent hornfelsed metasediments that has been traced over 400 metres along strike and is open in both directions. Additional sampling, detailed mapping, and follow up drilling is planned for this area in 2025.

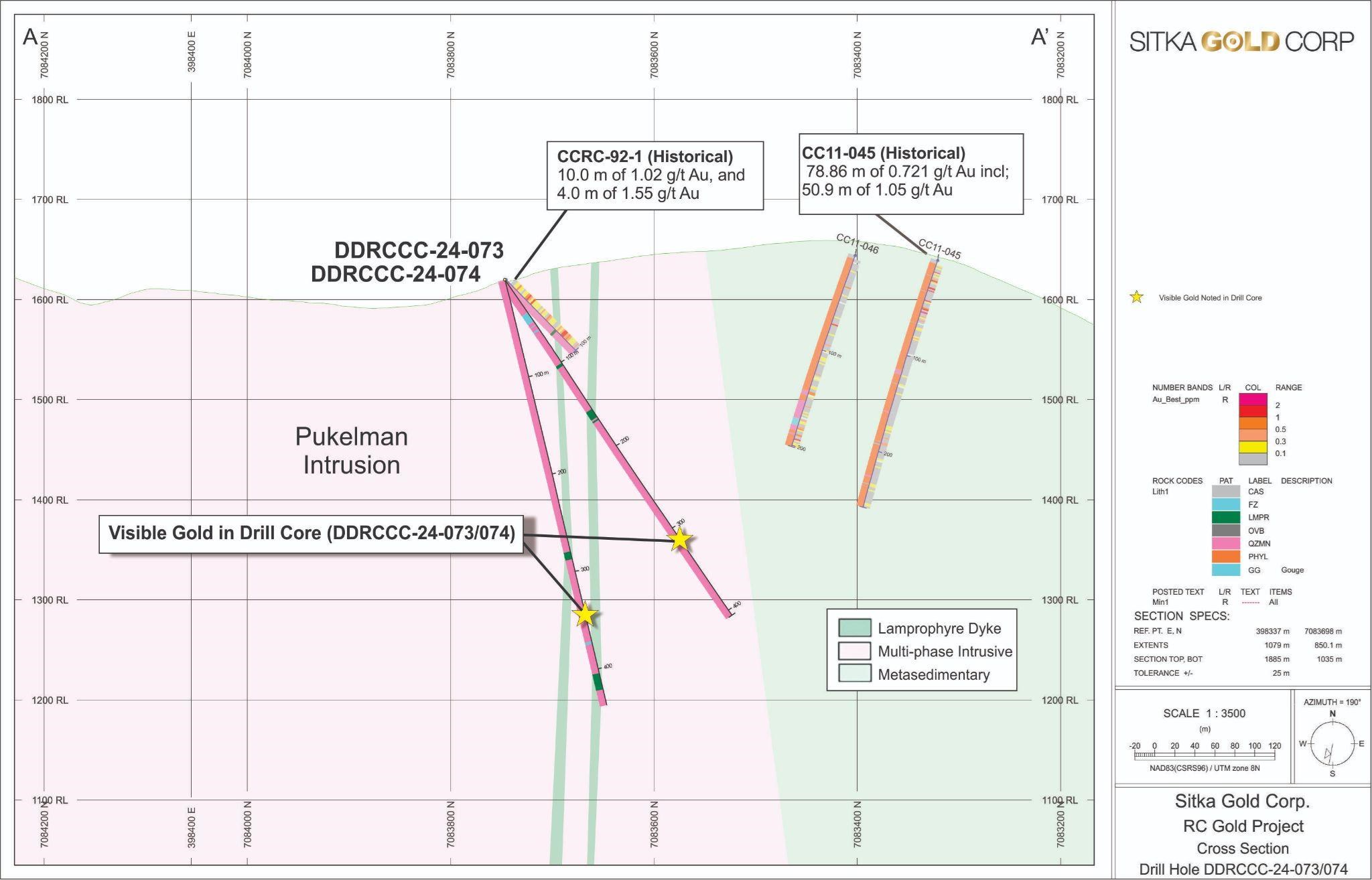

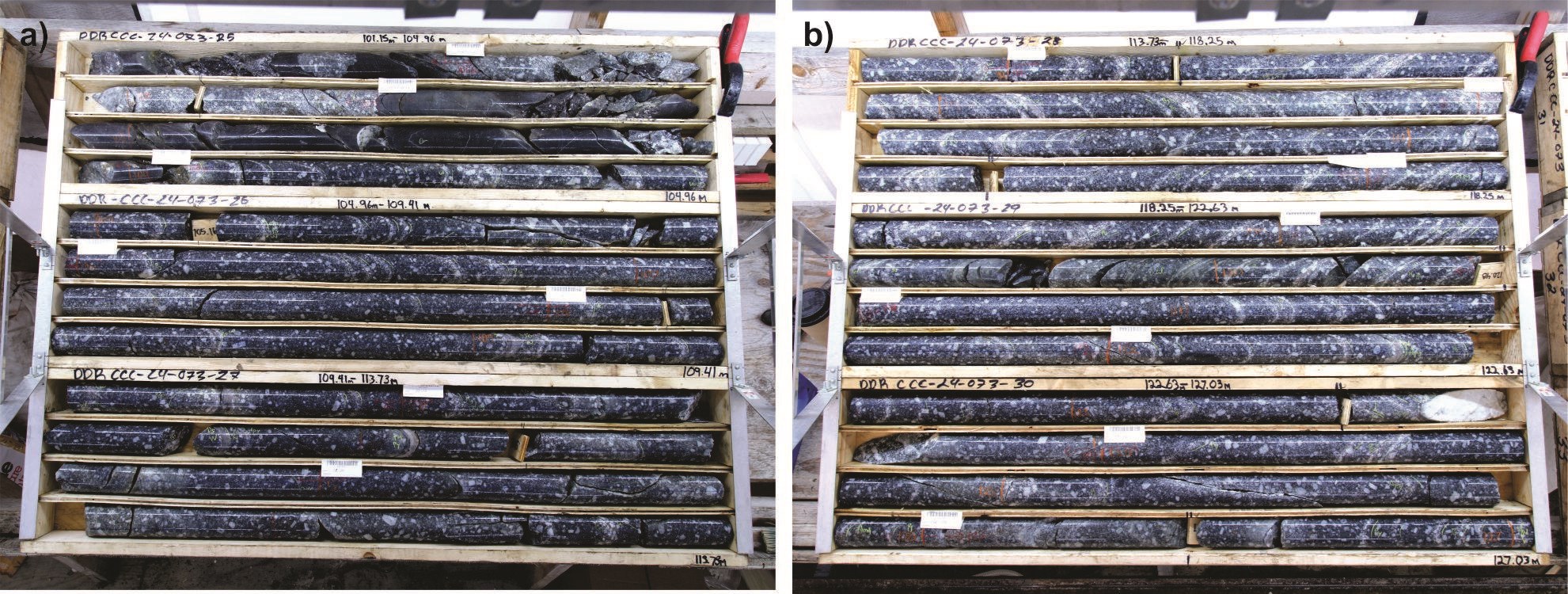

DDRCCC-24-073 and DDRCCC-24-074 were drilled from the same site testing sheeted quartz vein mineralization in the Pukelman intrusion where historical drill hole CCRC-92-1 returned 10.0 metres of 1.02 g/t Au and 4.0 metres of 1.55 g/t Au. The holes were located approximately 500 metres north of the Contact Zone where 2,368 metres of historical shallow reverse circulation and diamond drilling had returned broad zones of gold mineralization such as 74.3 metres of 1.0 g/t Au as well as intervals of higher-grade mineralization such as 10.7 metres of 20.46 g/t Au and 1.52 metres of 137.5 g/t Au (See Figure 3 and Sitka press release dated June 24, 2024).

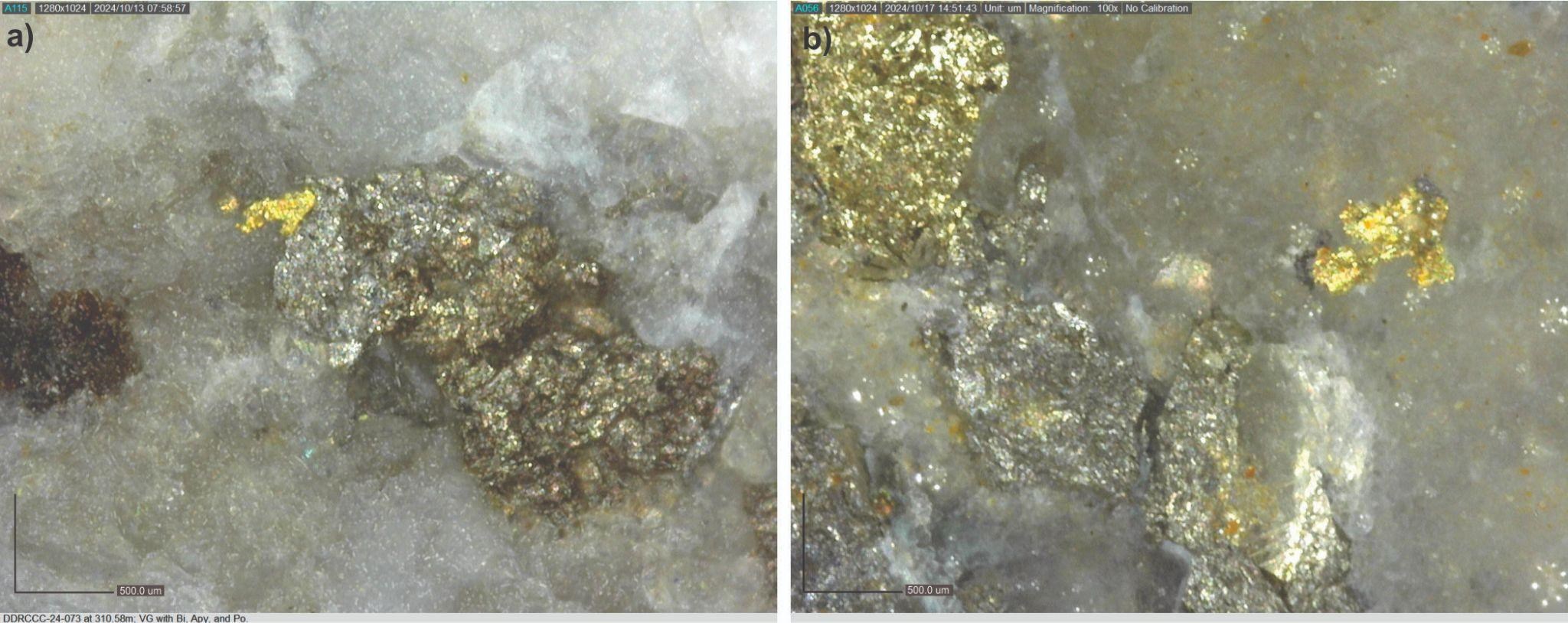

DDRCCC-24-073 was drilled at an azimuth of 190 degrees and a dip of -55 degrees to a total length of 406.3 metres. The hole intersected 406.3 metres of moderately to well mineralized, feldspar megacrystic quartz monzonite. Mineralization consisted of 1-2 cm sheeted quartz veins (1-2 per several metres up to 5-8 per metre) with potassium feldspar, minor scheelite, pyrrhotite, arsenopyrite, and pyrite. One instance of visible gold was noted at 310.6 metres. Three lamprophyre dykes were noted at 100.92-104.03 metres, 155.82-165.57 metres, and 167.15-168.87 metres demonstrating that the drilled area is within one of the east west extensional corridors that have been demonstrated to control gold mineralization in the CCIC.

DDRCCC-24-074 was drilled at an azimuth of 190 degrees and a dip of -75 degrees to a total depth of 437.4 metres. The hole intersected 437.39 m of moderately to well mineralized, feldspar megacrystic quartz monzonite. Mineralization consisted of 1-2 cm sheeted quartz veins (1-2 per several metres up to 5-8 per metre) with potassium feldspar, minor scheelite, pyrrhotite, arsenopyrite, and pyrite (trace Molybdenite). One example of visible gold was noted at 342.08 metres. Two lamprophyre dykes were noted at 279.5-287.5 and 404.4-421.4 metres. Lamprophyre dykes in the Clear Creek Intrusive Complex area are often associated with extensional corridors that host the gold mineralization.

Figure 4 – Cross section of the 2024 Pukelman diamond drill holes. Sitka’s initial diamond drill holes have extended mineralization approximately 300 metres deeper than previous drilling with visible gold observed at 310.6 metres and 342.1 metres in holes 73 and 74 respectively.

Figure 5 – Visible gold from a) DDRCCC-24-073, and b) DDRCCC-24-074, Sitka’s first diamond drill holes completed at the Pukelman intrusive target, showing the association of gold with arsenopyrite, pyrrhotite, pyrite, and bismuthinite.

Figure 6 – Drill core from hole DDRCCC-24-073 showing a narrow lamprophyre dyke (a), and abundant sheeted quartz veins (b).

Figure 7 – Sheeted quartz veining with pyrite-arsenopyrite mineralization in quartz monzonite from the Pukelman stock (a) and Brecciated and silicified quartz feldspar porphyry from the Contact Zone with arsenopyrite – pyrite – bismuthinite – visible gold mineralization where a rock sample returned 67.9 g/t gold (b).

About the flagship RC Gold Project

The RC Gold Project consists of a 431 square kilometre contiguous district-scale land package located in the heart of Yukon’s Tombstone Gold Belt. The project is located approximately 100 kilometres east of Dawson City, which has a 5,000 foot paved runway, and is accessed via a secondary gravel road from the Klondike Highway which is usable year-round and is an approximate 2 hour drive from Dawson City. It is the largest consolidated land package strategically positioned mid-way between the Eagle Gold Mine and the past producing Brewery Creek Gold Mine.

On January 19, 2023 Sitka Gold announced an Initial Mineral Resource Estimate prepared in accordance with National Instrument 43-101 (“NI 43-101”) guidelines for the RC Gold Property of 1,340,000 ounces of gold(1). The road accessible, pit constrained Mineral Resource is classified as inferred and is contained in two zones: The Blackjack and Eiger deposits with 900,000 ounces of gold grading 0.83 g/t and 440,000 ounces of gold grading 0.68 g/t respectively. Both of these deposits are at/near surface, are potentially open pit minable and amenable to heap leaching, with initial bottle roll tests indicating that the gold is not refractory and has high gold recoveries of up to 94% with minimal NaCN consumption (see News Release July 13, 2022). The Mineral Resource estimate is presented in the following table at a base case cut-off grade of 0.25 g/t Au:

RC Gold Inferred Mineral Resource Estimate

| COG g/t Au | Blackjack Zone | Eiger Zone | Combined | ||||||||

| Tonnes 000’s |

Au g/t | 0z Au 000’s |

Tonnes 000’s |

Au g/t | 0z Au 000’s |

Tonnes 000’s |

Au g/t | 0z Au 000’s |

|||

| 0.20 | 35,798 | 0.80 | 921 | 32,523 | 0.45 | 471 | 68,321 | 0.63 | 1,391 | ||

| 0.25 | 33,743 | 0.83 | 900 | 27,362 | 0.50 | 440 | 61,105 | 0.68 | 1,340 | ||

| 0.30 | 31,282 | 0.88 | 885 | 22,253 | 0.55 | 393 | 53,535 | 0.74 | 1,279 | ||

| 0.35 | 29,065 | 0.92 | 860 | 17,817 | 0.60 | 344 | 46,882 | 0.80 | 1,203 | ||

| 0.40 | 26,975 | 0.96 | 833 | 14,506 | 0.66 | 308 | 41,481 | 0.86 | 1,140 | ||

Notes

1. Mineral resource estimate prepared by Ronald G. Simpson of GeoSim Services Inc. with an effective date of January 19, 2023. Mineral Resources are classified using the 2014 CIM Definition Standards.

2. The cut-off grade of 0.25 g/t Au is believed to provide a reasonable margin over operating and sustaining costs for open-pit mining and processing.

3. Mineral resources are constrained by an optimised pit shell using the following assumptions: US$1800/oz Au price; a 45° pit slope; assumed metallurgical recovery of 85%; mining costs of US$2.00 per tonne; processing costs of US$8.00 per tonne; G&A of US$1.50/t.

4. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

5. Totals may not sum due to rounding.

To date, 76 diamond drill holes have been drilled on the property by the Company for a total of approximately 28,535 metres including 20 drill holes totalling 9,263 metres completed in 2024 focused on exploration and expanding the initial resource. The drilling in 2024, so far, produced results of up to 678.1 m of 1.04 g/t gold from 4.4 m including 409.5 m of 1.36 g/t gold from 273.0 m in hole DDRCCC-24-068 (see news release dated October 21, 2024). Assay results for a total of eight drill holes at Blackjack, Rhosgobel (5 kms south of the Blackjack deposit) and Pukelman (2 kms SE of the Blackjack deposit) targeting known intrusion related gold mineralization are pending.

(1) Simpson, R. January 19, 2023. Clear Creek Property, RC Gold Project, NI 43-101 Technical Report, Dawson Mining District, Yukon Territory

RC Gold Deposit Model

Exploration on the Property has mainly focused on identifying an intrusion-related gold system (“IRGS”). The property is within the Tombstone Gold Belt which is the prominent host to IRGS deposits within the Tintina Gold Province in Yukon and Alaska. Notable deposits from the belt include: Fort Knox Mine in Alaska with current Proven and Probable Reserves of 230 million tonnes at 0.3 g/t Au (2.471 million ounces; Sims 2018)(1); Eagle Gold Mine with current Measured and Indicated Resources of 233 million tonnes at a grade of 0.57 g/t Au at the Eagle Main Zone (4.303 million ounces; Harvey et al, 2022)(2); the Brewery Creek deposit with current Indicated Mineral Resource of 22.2 million tonnes at a gold grade of 1.11 g/t (0.789 million ounces; Hulse et al. 2020)(3); the Florin Gold deposit, located adjacent to Sitka’s RC Gold project, with a current Inferred Mineral Resource of 170.99 million tonnes grading 0.45 g/t (2.47 million ounces; Simpson 2021)(4) and the AurMac Project with an Inferred Mineral Resource of 347.49 million tonnes grading 0.63 gram per tonne gold (7.00 million ounces)(5).

(1) Sims J. Fort Knox Mine Fairbanks North Star Borough, Alaska, USA National Instrument 43-101 Technical Report. June 11, 2018. https://s2.q4cdn.com/496390694/files/doc_downloads/2018/Fort-Knox-June-2018-Technical-Report.pdf

(2) Harvey N., Gray P., Winterton J., Jutras M., Levy M.,Technical Report for the Eagle Gold Mine, Yukon Territory, Canada. Victoria Gold Corp. December 31, 2022. https://vgcx.com/site/assets/files/6534/vgcx_-_2023_eagle_mine_technical_report_final.pdf

(3) Hulse D, Emanuel C, Cook C. NI 43-101 Technical Report on Mineral Resources. Gustavson Associates. May 31, 2020. https://minedocs.com/22/Brewery-Creek-PEA-01182022.pdf

(4) Simpson R. Florin Gold Project NI 43-101 Technical Report. Geosim Services Inc. April 21, 2021. https://sedar.com/GetFile.do?lang=EN&docClass=24&issuerNo=00005795&issuerType=03&projectNo=03236138&docI d=4984158

(5) Thornton T., Jutras M., Malhotra D. Technical Report Aurmac Property Mayo Mining District, Yukon Territory, Canada. JDS Energy and Mining Inc. February 6, 2024. https://banyangold.com/site/assets/files/5251/banyan_gold_ni_43-101_technical_report_2024_03_18.pdf

Soil and Rock Preparation and Analysis Procedures

Soil samples were shipped to Bureau Veritas preparation facility in Whitehorse in securely sealed containers and prepared using the SS80 method. Prepared samples were shipped to the Bureau Veritas facility in Vancouver and analysed by the AQ201+U method.

Rock samples were shipped to the ALS Global analytical facility in Whitehorse in securely sealed containers and prepared using the PREP31 method. Prepared material was shipped to the ALS facility in North Vancouver and analysed by the ME-ICP41 and Au-ICP22 methods. Rock samples were “Grab Samples” and thus do not imply any thickness or areal extent of mineralization.

Both Bureau Veritas and ALS Global are ISO 17025:2005 certified facilities that employ rigorous internal QA-QC procedures.

Upcoming Events

Sitka Gold will be attending and/or presenting at the following events*:

- Takestock Investor Forum, Calgary, AB: November 6, 2024

- MEG Technical Talk, Vancouver, BC: November 13, 2024

- Yukon Geoscience, Whitehorse, Yukon: November 17 – 20, 2024

- American Exploration and Mining Association Conference, Reno, NV: December 1 – 6, 2024

- Metal Investors Forum, Vancouver, BC: January 17-18

- VRIC, Vancouver, BC: January 19 – 20, 2025

- RoundUp, Vancouver, BC: January 20-23, 2025

*All events are subject to change.

About Sitka Gold Corp.

Sitka Gold Corp. is a well-funded mineral exploration company headquartered in Canada with over $10 million in its treasury and no debt. The Company is managed by a team of experienced industry professionals and is focused on exploring for economically viable mineral deposits with its primary emphasis on gold, silver and copper mineral properties of merit. Sitka is currently advancing its 100% owned, 431 square kilometre flagship RC Gold Project located within the Tombstone Gold Belt in the Yukon Territory. The Company is also advancing its Alpha Gold Project in Nevada and currently has drill permits for its Burro Creek Gold and Silver Project in Arizona and the Coppermine River Project in Nunavut.

The Company recently announced an NI 43-101 compliant initial inferred Mineral Resource Estimate of 1,340,000 ounces of gold(1) beginning at surface and grading 0.68 g/t at its RC Gold Project in Yukon (see news release dated January 19, 2023).

(1) Simpson, R. January 19, 2023. Clear Creek Property, RC Gold Project, NI 43-101 Technical Report, Dawson Mining District, Yukon Territory

*For more detailed information on the Company’s properties please visit our website at www.sitkagoldcorp.com.

The scientific and technical content of this news release has been reviewed and approved by Cor Coe, P.Geo., Director and CEO of the Company, and a Qualified Person (QP) as defined by National Instrument 43-101.

ON BEHALF OF THE BOARD OF DIRECTORS OF

SITKA GOLD CORP.

“Donald Penner“

President and Director

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary and Forward-Looking Statements

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-Looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as “intends” or “anticipates”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “should”, “would” or “occur”. This information and these statements, referred to herein as “forward‐looking statements”, are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management’s expectations and intentions and the Company’s anticipated work programs.

These forward‐looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, market uncertainty and the results of the Company’s anticipated work programs.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. We seek safe harbor.

Resource World Magazine Inc. has prepared this editorial for general information purposes only and should not be considered a solicitation to buy or sell securities in the companies discussed herein. The information provided has been derived from sources believed to be reliable but cannot be guaranteed. This editorial does not take into account the readers investment criteria, investment expertise, financial condition, or financial goals of individual recipients and other concerns such as jurisdictional and/or legal restrictions that may exist for certain persons. Recipients should rely on their own due diligence and seek their own professional advice before investing.

[ad_2]

Source link