[ad_1]

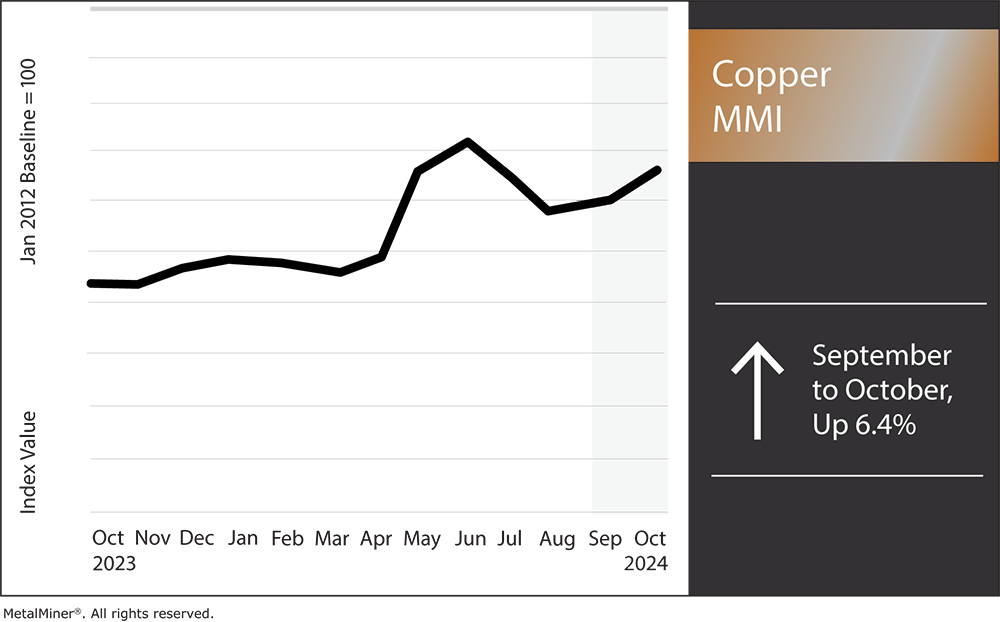

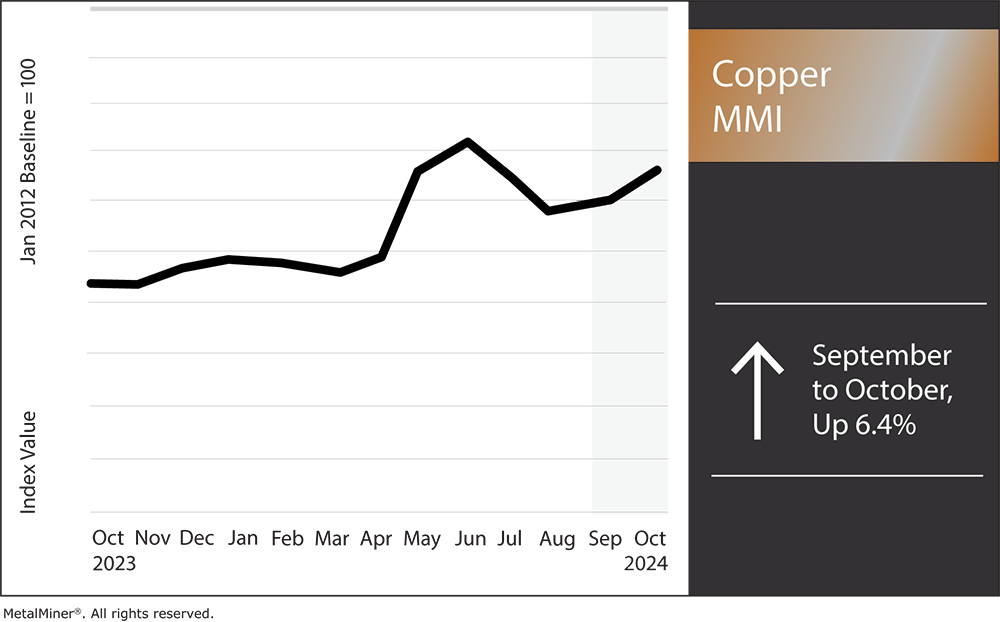

Overall, the Copper Monthly Metals Index (MMI) accelerated from the previous month, with a 6.4% rise from September to October.

Comex copper prices outperformed other base metals during September, as the price of copper rose 9.55% to close the month above the $10,000 per metric ton mark. By October 4, prices found at least a short-term peak followed by a modest retracement in the following week.

Copper and other commodity markets are constantly shifting. Get all of the latest updates with MetalMiner’s weekly newsletter.

The Price of Copper Loses Luster Following September Rally

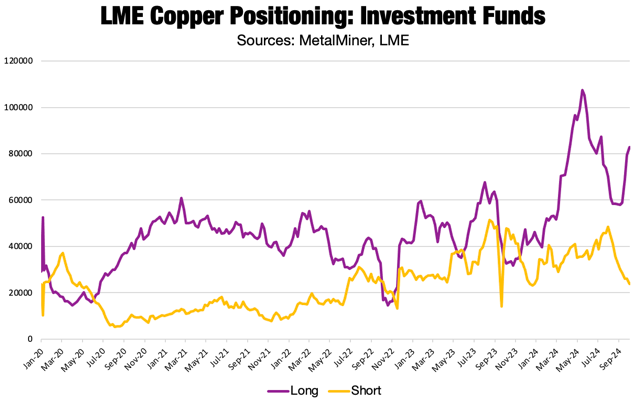

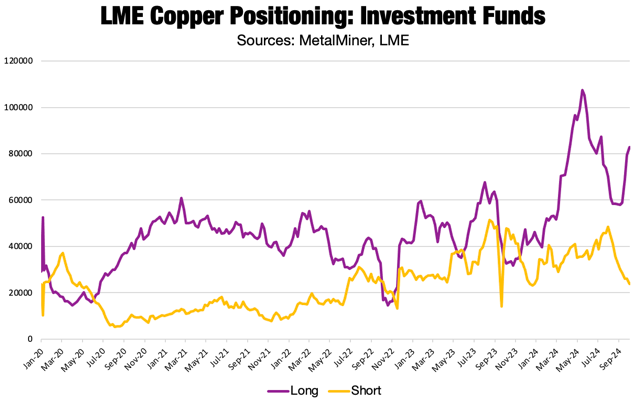

Copper prices embarked on a rebound throughout September, which saw them challenge their early July peak by October 3. Supported by an over 43% increase in long bets from investment funds between late August and early October, prices rose almost 15% from their September low as they broke above their short-term range. Investors were quick to respond to September’s 50-basis-point cut from the Federal Reserve, the port strike and Chinese stimulus, all of which helped boost bullish sentiment.

However, the outlook began to shift by mid-October. The port strike, which could have impacted trade flows and curtailed copper supply in the U.S., was resolved after just three days. This prevented a supply squeeze similar to the one that saw the copper price find a new all-time high in May. While the strike proved costly, it was too brief to meaningfully disrupt the supply chain.

Markets Await More Chinese Stimulus

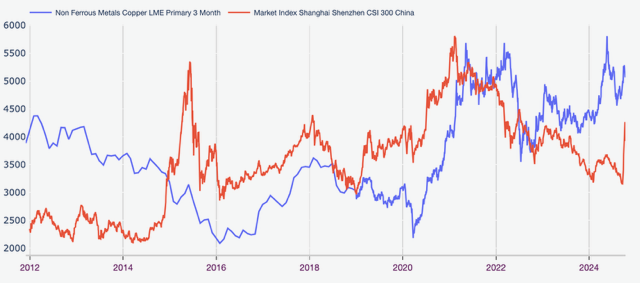

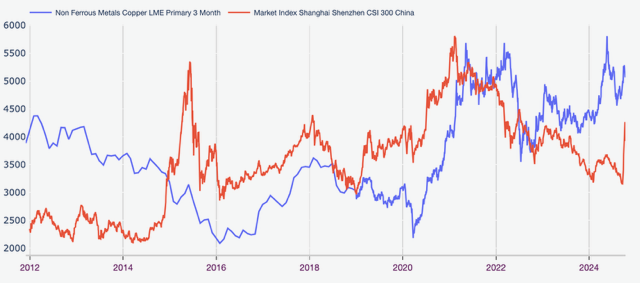

Meanwhile, China made a big step toward saving its troubled economy. Among the new measures were a cut to certain lending rates by the PBOC, lower reserve requirements for banks, lower down-payment ratios for second-home buyers and at least $113 billion in liquidity support for stock purchases and buybacks. This announcement saw the CSI 300 index, a proxy for the top stocks traded on the Shanghai and Shenzen Stock Exchanges, rise 20.97% during September.

Many expected more announcements to follow as the scale of the package, while large, appeared too small to resolve longstanding issues with its property sector and lack of consumer confidence. As the boost from the initial announcement began to fade, by October 12, China’s finance minister pledged to “significantly increase” the country’s debt, which will include support for local governments and the property market, subsidies for low-income citizens, and increased capital for state banks.

Although stimulus typically proves supportive for copper prices, China left markets with a note of uncertainty at the conclusion of its press conference. Finance Minister Lan Foan chose not to mention the actual size of the package or the exact timeframe funds will be released. This could see investors respond cautiously until China lays a clearer roadmap in the coming weeks. China’s lack of clarity risks volatility, however, as if markets once again deem the size of the of the latest package too small, this could see the recent rallies for the CSI 300, China FXI and copper prices collapse.

Source: MetalMiner Insights, Chart & Correlation Analysis Tool

Worried about volatility in the price of copper? MetalMiner Insights covers price points, correlation charts and price forecasting for a full suite of copper forms. See our full metals catalog.

Copper Supply Forecasts Increase

The overall copper market has largely disappointed bulls over the last year. Copper remains a key metal for electrification and energy transition efforts around the world. However, comparing copper demand from those projects with available copper supply over the next decade has led most analysts to conclude that the market will witness an unrelenting deficit. While fundamentals do not necessarily determine price action, a widening deficit would likely see the price of copper surge.

That said, the market outlook has faced more than a few snags since most of those forecasts came out. For example, China’s recovery from the pandemic proved lackluster at best. Even considering the recent stimulus announcements, the substantial oversupply within the housing market amid a declining population suggests little need to build further. Without a growing property sector, copper demand in China has had to rely on other sectors instead.

ICSG Revises Estimates for 2024 and 2025

At the same time, energy transition efforts have seen repeated scaling back worldwide. While there are still plenty of bullish influences on the horizon, thus far, groups have started to temper expectations. Most prominently, the International Copper Study Group released a new forecast in late September that threw cold water on supply concerns.

The ICSG increased surplus expectations for both 2024 and 2025 by a large margin. Compared to its last press release on April 29, the ICSG increased its surplus forecast for 2024 by 190%, from 162,000 tons to 469,000 tons. For 2025, figures increased by 106%, from 94,000 to 194,000 tons.

While these numbers are merely estimates, the revisions factor in lower-than-expected copper demand growth this year and next. Of course, black swan events, like the subsequently averted port strike, will always remain a possibility that could shift the overall outlook. Beyond that, supply conditions do not necessarily dictate price action. However, the revised forecast from groups like the ICSG will help temper the bullish sentiment that saw copper prices touch a fresh all-time high a little more than three months ago.

Biggest Copper Price Moves

Read what’s next for copper prices in this month’s Monthly Metals Outlook. The report provides both short-term and long-term forecasts plus buying strategies, giving you the edge to navigate market volatility. Secure a free sample report and opt into a subscription.

- Chinese copper wire prices jumped 10.03% to $11,232 per metric ton as of October 1.

- Chinese copper scrap prices rose 7.94% to $11,219 per metric ton.

- Chinese copper wire scrap prices saw a 7.27% increase to $10,396 per metric ton.

- LME primary three month copper prices rose 6.87% to $9,907 per metric ton.

- Korean copper strip prices witnessed the only decline of the overall index, with a modest 2.53% decrease to $11.32 per kilogram.

[ad_2]

Source link